Solved: Corporate Finance-The Case of Burberry Group Plc

Burberry group Plc is a renowned conglomerate within the retail industry, it manufactures, whole-sells and retails contemporary luxury goods. The company also issues licenses to third parties to manufacture and distribute products via its trademarks. Burberry’s retail/wholesale segment has a wide range of channels in its sale of luxurious goods to name a few; mainline stores, concession, outlets, digital commerce, franchises as well as its prestigious department stores. The licensing segment is engaged in the receipt of royalties from its offshore partners in Japan which licenses eye-ware, wrist-ware and children’s-wear. Its product main classification entails Women, Men and Children apparel, further it also manufactures and produces accessories and beauty products. https://markets.ft.com/data/equities/tearsheet/profile?s=BRBY:LSE LO1 & LO5- Evaluate the risk profile of the firm, and examine the sources of risk.

- Analyse the firm’s What is the breakdown of stockholders in your firm - insiders, individuals and institutional?

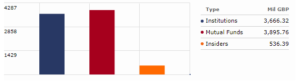

The above graph clearly demonstrates that Burberry has three main categorical owners, Institutions, Mutual Funds and Insiders. The total of institutions amounts to 412 where as its fund owners totaling 1,173. From the analysis below the Group Market capitalization is a staggering 7.47bn GBP out of this figure 45.05% is owned by institutions, 47.87% by funds and the remainder of 7.18% by insiders.

Pls. see the equity ownership top five funds and institutions:

The above graph clearly demonstrates that Burberry has three main categorical owners, Institutions, Mutual Funds and Insiders. The total of institutions amounts to 412 where as its fund owners totaling 1,173. From the analysis below the Group Market capitalization is a staggering 7.47bn GBP out of this figure 45.05% is owned by institutions, 47.87% by funds and the remainder of 7.18% by insiders.

Pls. see the equity ownership top five funds and institutions:

LO3

LO3

- How risky is this company’s equity? What is its cost of equity?

- Risk-Free Rate of Return -The 10 year Treasury Constant Maturity has been utilized as risk free and as for the current risk free rate is 12.4%

- Beta – According to markets.ft.com the sensitivity of the expected asset returns to the expected excess market returns Burberrys Beta is 1.5001.

- Market Premium - In regards to calculating the market premium, according to (Anon., n.d.) the MP is 6% As the result: Cost of Equity = 1.24% + 1.5001 * 6% = 8.7%

- How risky is this company’s debt? What is its cost of debt?

- What is this company’s current cost of capital?

- weight of equity = E / (E + D) = 7,470/ (7,470 + 34.3) = 0.99547

- weight of debt = D / (E + D) = 34.3/ (7,470 + 34.3) = 0.0046

- Examine the firm’s investment choices.

- How has this company returned cash to its owners? Has it paid dividends or bought back stock?

- How much cash has the firm accumulated over time? Given this firm’s characteristics today, how would you recommend that they return cash to stockholders (assuming that they have excess cash)?

- How much cash could this firm have returned to its stockholders over the last few years? How much did it actually return?

- Given this dividend policy and the current cash balance of this firm, would you push the firm to change its dividend policy (return more or less cash to its owners)?

- How does this firm’s dividend policy compare to those of its peer group and to the rest of the market?

- What is company’s market value and what is the “key variable” (risk, growth, leverage, profit margins...) driving this value? (10 marks)

- If you were hired to enhance value at this firm, what would be the path you would choose? (10 marks)