Solved: Essentials to accounting

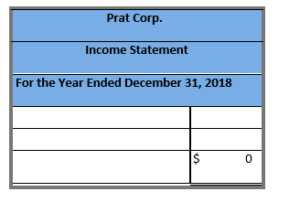

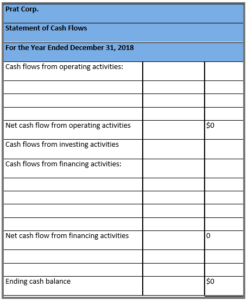

Required information [The following information applies to the questions displayed below.] Prat Corp. started the 2018 accounting period with $37,000 of assets (all cash), $15,500 of liabilities, and $12,000 of common stock. During the year, the Retained Earnings account increased by $14,550. The bookkeeper reported that Prat paid cash expenses of $29,500 and paid a $2,700 cash dividend to the stockholders, but she could not find a record of the amount of cash that Prat received for performing services. Prat also paid $10,000 cash to reduce the liability owed to the bank, and the business acquired $8,500 of additional cash from the issue of common stock. Required (Hint: Determine the amount of beginning retained earnings before considering the effects of the current period events. It also might help to record all events under an accounting equation before preparing the statements.)- a-1.Prepare an income statement for the 2018 accounting period.

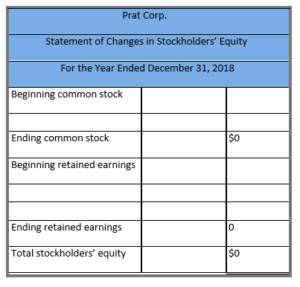

- a-2.Prepare a statement of changes in stockholders’ equity for the 2018 accounting period.

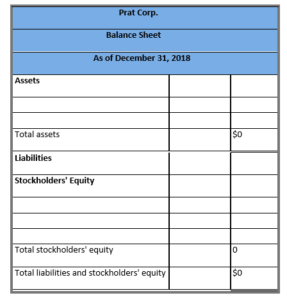

- a-3.Prepare a period-end balance sheet for the 2018 accounting period.

- a-4.Prepare a statement of cash flows for the 2018 accounting period.

- Req A1

- Req A2

- Req A3

- Req A4

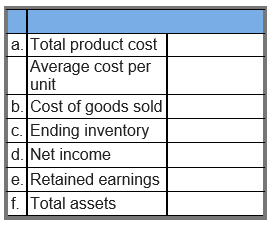

Campbell Manufacturing Company was started on January 1, 2018, when it acquired $89,000 cash by issuing common stock. Campbell immediately purchased office furniture and manufacturing equipment costing $9,100 and $36,000, respectively. The office furniture had an eight-year useful life and a zero salvage value. The manufacturing equipment had a $4,000 salvage value and an expected useful life of four years. The company paid $11,900 for salaries of administrative personnel and $15,400 for wages to production personnel. Finally, the company paid $9,280 for raw materials that were used to make inventory. All inventory was started and completed during the year. Campbell completed production on 4,300 units of product and sold 3,350 units at a price of $15 each in 2018. (Assume that all transactions are cash transactions and that product costs are computed in accordance with GAAP.)

Required

Campbell Manufacturing Company was started on January 1, 2018, when it acquired $89,000 cash by issuing common stock. Campbell immediately purchased office furniture and manufacturing equipment costing $9,100 and $36,000, respectively. The office furniture had an eight-year useful life and a zero salvage value. The manufacturing equipment had a $4,000 salvage value and an expected useful life of four years. The company paid $11,900 for salaries of administrative personnel and $15,400 for wages to production personnel. Finally, the company paid $9,280 for raw materials that were used to make inventory. All inventory was started and completed during the year. Campbell completed production on 4,300 units of product and sold 3,350 units at a price of $15 each in 2018. (Assume that all transactions are cash transactions and that product costs are computed in accordance with GAAP.)

Required

- Determine the total product cost and the average cost per unit of the inventory produced in 2018. (Round "Average cost per unit" to 2 decimal places.)

- Determine the amount of cost of goods sold that would appear on the 2018 income statement. (Do not round intermediate calculations.)

- Determine the amount of the ending inventory balance that would appear on the December 31, 2018, balance sheet. (Do not round intermediate calculations.)

- Determine the amount of net income that would appear on the 2018 income statement. (Round your answer to the nearest dollar amount.)

- Determine the amount of retained earnings that would appear on the December 31, 2018, balance sheet. (Round your answer to the nearest dollar amount.)

- Determine the amount of total assets that would appear on the December 31, 2018, balance sheet. (Round your answer to the nearest dollar amount.)

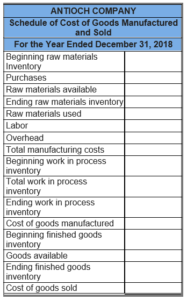

Required information

[The following information applies to the questions displayed below.] Antioch Company makes eBook readers. The company had the following amounts at the beginning of 2018: Cash, $674,000; Raw Materials Inventory, $59,000; Work in Process Inventory, $19,000; Finished Goods Inventory, $55,000; Common Stock, $598,000; and Retained Earnings, $209,000. Antioch experienced the following accounting events during 2018. Other than the adjusting entries for depreciation, assume that all transactions are cash transactions.- Paid $26,000 of research and development costs.

- Paid $49,000 for raw materials that will be used to make eBook readers.

- Placed $96,000 of the raw materials cost into the process of manufacturing eBook readers.

- Paid $78,000 for salaries of selling and administrative employees.

- Paid $93,000 for wages of production workers.

- Paid $92,000 to purchase equipment used in selling and administrative offices.

- Recognized depreciation on the office equipment. The equipment was acquired on January 1, 2018. It has a $12,000 salvage value and a eight-year life. The amount of depreciation is computed as [(Cost – salvage) ÷ useful life]. Specifically, ($92,000 – $12,000) ÷ 8 = $10,000.

- Paid $125,000 to purchase manufacturing equipment.

- Recognized depreciation on the manufacturing equipment. The equipment was acquired on January 1, 2018. It has a $21,000 salvage value and a eight-year life. The amount of depreciation is computed as [(Cost – salvage) ÷ useful life]. Specifically, ($125,000 – $21,000) ÷ 8 = $13,000.

- Paid $62,000 for rent and utility costs on the manufacturing facility.

- Paid $73,000 for inventory holding expenses for completed eBook readers (rental of warehouse space, salaries of warehouse personnel, and other general storage cost).

- Completed and transferred eBook readers that had total cost of $245,000 from work in process inventory to finished goods.

- Sold 830 eBook readers for $425,000.

- It cost Antioch $132,800 to make the eBook readers sold in Event 13.

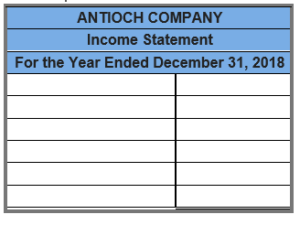

c-2. Prepare a formal income statement for the year.

c-2. Prepare a formal income statement for the year.

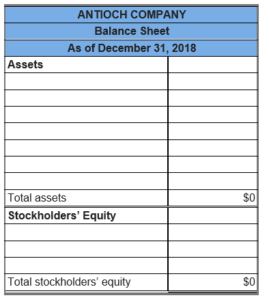

c-3. Prepare a balance sheet for the year.

c-3. Prepare a balance sheet for the year.