Solved: Herb has a business, Biggers Inc Case

Herb has a business, Biggers Inc., that sells custom made furniture. Herb currently has a small business in England but is considering expanding the business in a significant way.

The new business would involve an investment in a new manufacturing facility which would cost . For the purpose of valuing this project, you can assume that the manufacturing facility will cost £250 million today. This amount will be depreciated straight-line for tax purposes with no salvage value.

For simplicity you can assume the business will operate identically for each of the 10 years. For each year, sales will be £150 million, operating costs will be 62% of sales. Taxes will be charged at a rate 35% of EBIT.

There will be an initial investment in inventory at 12.5% of sales. This will be recovered at the end of the last year. Because of the mix of retail vs. commercial sales, accounts receivable will be at a level of 15 days of sales. The receivable will appear at the end of the first month (assume at time = 0 for simplicity), and will be recovered 1 month after the final year (assume at time = 10 for simplicity). Accounts payable will be at the level of 20 days of operating costs. Assume the same timing as for accounts receivable.

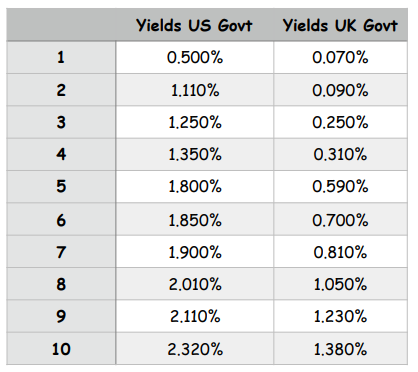

The following are annual yields on government bonds that can be used to forecast exchange rates:

Suppose the unlevered cost of equity capital is 12% and there is no plan to use debt but the cost of debt is 7%.

Problem 1, what is the NPV of the project from the perspective of the US company? Yields US Govt Yields UK Govt

Problem 2, suppose the UK Government is willing to lend Herb’s business £100 million at a favorable interest rate of 5%. The interest is tax deductible and the loan is repayable in fixed payments (of course, as with a mortgage, the mix of interest and principal will vary each year) each of the next 5 years based on the 5% rate. How will this arrangement change the NPV of the project? Hint: You will need to create an amortization table based on the 5% rate. This is necessary as you need to know the interest component of the payment as only this is tax deductible.