Final Project Company Selection and Preliminary Recommendations

Overview: For this task, you will choose and examine a publicly-listed company—one that you are considering analyzing for your final project—and make preliminary recommendations on global market expansion.

Prompt: First, review the Final Project Guidelines and Rubric document so that you understand the scope of the final project. Then visit the webpage SEC EDGAR Company Filings and review the Preliminary Final Project Company Selection Guide.

Next identify the publicly listed company that you are considering analyzing for your final project, and address the following:

Company Selection: Explain why you have you chosen this company for your final project, for example, personal interest, business interest, or

professional interest, etc.

Markets/Impact: In which financial markets does the selected company operate and how do those markets impact the company?

Risk Mitigation: Briefly describe how this company mitigates risk, for example, swaps, options, or other.

Expansion: What countries do you think the company might successfully expand into, and what potential risks might the company encounter with its

expansion? In other words, if the company is not present in South Africa, and you suggest moving to South Africa, would the company need more or less hedging?

Refer to the text readings and to the Form 10-K or Form 10-K/A annual statements from the SEC EDGAR Company Filings website to support your responses. As a reference, you should use the financial statements and website of the company you have selected.

Incorporate instructor feedback into Final Project Milestone One: Introduction and Broad Strokes of the Expansion Plan, due in Module Three.

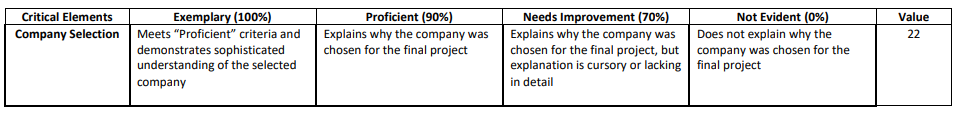

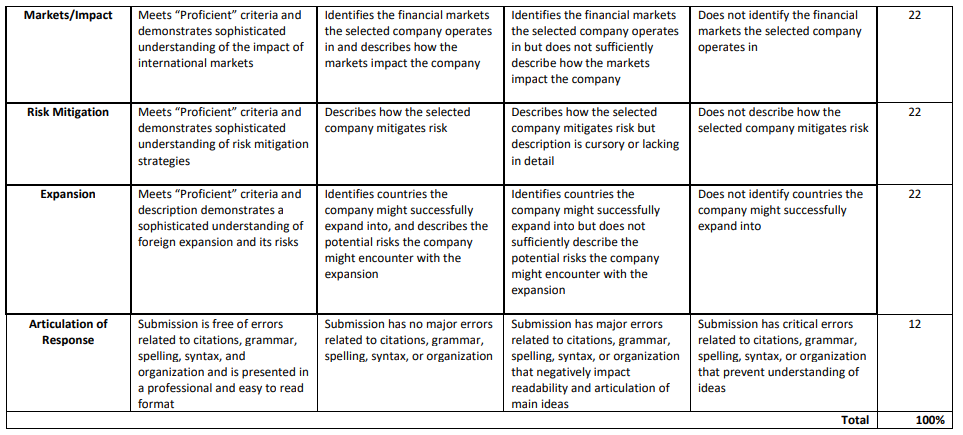

Rubric

Guidelines for Submission: The short paper should follow these formatting guidelines: 2–3 pages in length, double spaced, 12-point Times New Roman font, one-inch margins, and citations in APA style.