AC 753 Case#3

You may work in PAIRS (no more than 2 per group). Do NOT share OR discuss your work with other individuals or teams; it will result in an F for the course. The assignment is worth a total of 135 points and is due by the beginning of class on April 8, 2019. If you work with others please turn in only one copy with both names listed. Your answer should be one cohesive professional document and if submitted via BB submit as one file. You will be graded on presentation and grammar as well as content.

This is worth 135 points in total. Given the following information, provide an analysis of the tax implications of the transactions to shareholders Sponge Bob, Patrick Star, Mr. Krabs and Squidward Tentacles, all unrelated shareholders. This should include the formation of Bikini Bottom, the distributions to shareholders and the exit of certain (or all) shareholders. Analysis should be presented on a yearly basis (i.e., tax implications of each year, each transaction to each shareholder and the corporation). This is one cohesive scenario. Information carries from year to year. Include primary authority citations to support your positions ONLY where indicated below.

Formation (Year 0):

(40 points)

Note: Corporate formation should be a review from your introductory tax class. If you did not cover this in your tax class see me for extra help. For those of you who simply need a review see your text book then come to me with questions.

Sponge Bob (Bob), Squidward Tentacles (Squid), Patrick Star (Patrick) and Mr. Krabs (Krabs) decide to form Bikini Bottom, Inc. The corporation will develop, manufacture and distribute pineapple houses. Bikini Bottom, Inc. is formed with the following contributions:

Bob decides to contribute a building and land. The land has a basis of $60,000 and a FMV of $80,000. Bikini Bottom, Inc. will also assume the mortgage on the land, which is $90,000. The building has a basis of $90,000 and a FMV of $200,000. In return, Bikini Bottom, Inc. will give Bob 386 shares of stock worth $170,000 and also pay Bob $20,000 in cash.

Patrick will contribute equipment that has a FMV of $80,000 and an adjusted basis of $100,000. In addition to stock, Patrick receives $5,000 in cash and 170 shares of stock worth $75,000.

Squid recently got his law degree and will provide legal services for Bikini Bottom. The fair market value of these services is $20,000. Squid’s continuing services will be billed as incurred. He receives 45 shares of stock worth $20,000.

Krabs, the brains of the outfit, will contribute his know-how. Specifically, Krabs is in the process of creating software that will mass-produce the pineapple homes and likely result in a future patent. The software development is worth $75,000. Include a citation of primary authority to support your classification of the software as either property or services (you do not need a research memo just a citation and brief one or two sentence explanation). Additionally he will contribute cash of $100,000. He receives 398 shares of stock worth $175,000.

A. What are the tax implications of the formation to each shareholder and Bikini Bottom?

B. Squid would like to know (for future reference ONLY; it would not affect this transaction) what would be different if he contributed cash or tangible property in addition to his services. Would that change anything in the formation? This is a small discussion question, not a research memo. Your answer should be a short paragraph with a primary authority citation.

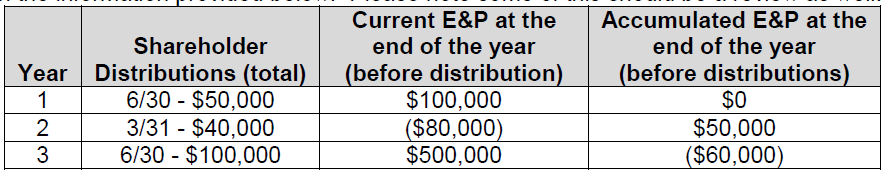

Operations: (Year 1 – 3): (30 points)

The following summarizes the annual results of the business. There is no need to discuss the treatment of taxable income/loss each year at the corporate level since that information is not given nor can you compute it from the information given. Just discuss the tax effect to the shareholders and E&P based on the information provided below. Please note some of this should be a review as well:

Exit Strategy: (65 points)

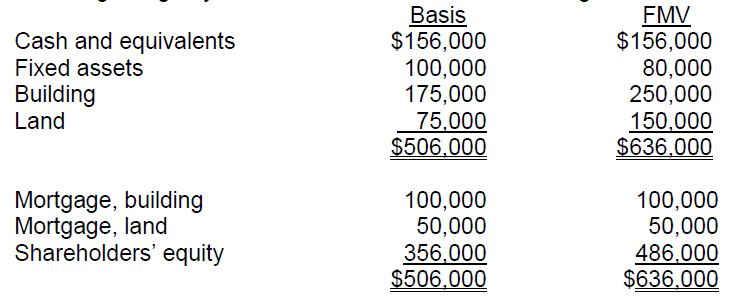

By the beginning of year 4, Krabs, Bob and Patrick are ready to get rid of Squid as he is quite disagreeable. Evaluate each exit strategy independently and in detail describing the tax implications to all parties involved (including Bikini Bottom). After you evaluate each alternative, in a separate summary paragraph, recommend the best overall option describing the reasons for your conclusion. At the beginning of year 4, Bikini Bottom has the following Balance Sheet:

Strategy 1:

Bobs, Krabs and Patrick figure they can accomplish pushing Squid out of the business by shrinking the business as an excuse to get rid of a shareholder. They will contract the business about 25% in total (including sales, inventory, accounts receivable) and redeem Squid’s stock for $50,000. What are the tax implications to the shareholders and Bikini Bottom?

Strategy 2:

At the beginning of year 4 the owners could liquidate the business and part ways. Upon liquidation, Squid will receive the land and assume the mortgage; Bob will receive the building and assume the mortgage; Patrick will receive the fixed assets; Krabs will receive any remaining cash after the business winds up. What are the tax implications to the shareholders and Bikini Bottom?

Strategy 3:

At the beginning of year 4, Bikini Bottom could merge with Warner Brothers, Inc. (WB). WB could purchase the shares of stock from each shareholder for $500 per share. WB and Bikini Bottom would then make a §338 election to treat this sale as an asset acquisition. Then WB would liquidate Bikini Bottom.

Strategy 4:

At the beginning of year 4 Bikini Bottom could merge with Warner Brothers, Inc. (WB). WB would swap each share of Bikini Bottom stock with its own stock. For each share of Bikini Bottom stock, the shareholder would receive $550 worth of WB stock. Then WB would liquidate Bikini Bottom. Include the primary authority citation for the tax treatment of this transaction (not a memo, a sentence).