Fundamentals of Actuarial Practice: Interim Assessment

Questions

Interim Assessment Questions Overview

Assessment Structure

This assessment comprises 14 questions you are to answer. All questions are listed in this document. Questions are grouped into the following sections:

x Questions 1-5 relate to a group term life insurance scenario.

x Questions 6-10 relate to an individual disability insurance scenario.

x Questions 11-12 relate to an ERM scenario.

x Questions 13-14 are independent of each other and are not linked to a shared scenario.

Your answers to the questions are to be contained in one Microsoft Word document that you will submit when completed with the Interim Assessment. You must use the template document (either “IA_template.doc” or “IA_template.docx”) that you downloaded when obtaining this document and the spreadsheets. You will also submit the spreadsheet containing the work you complete for the first scenario (Questions 1 – 5). (Further information about the process for completing the Interim Assessment can be found by clicking the “Interim Assessment FAQ” or “Interim Assessment Instructions” links on the Download Page.)

Important Notes

All information you want to convey to graders must be in your Microsoft Word document. Your answers should be presented with an 11-point (minimum) font and single-spaced (with double spacing between paragraphs).

You should not assume that graders will examine the Microsoft Excel spreadsheet you upload. While graders will have access to your Excel file, they will only review your spreadsheet if they would like to check your work.

Considerations in Preparing Your Answers

For the most part, your answers are not expected to be in memo form and do not need to be in structured paragraphs. It is acceptable to use outlines and lists where you believe it is appropriate. However, if the question calls for you to write a memo or document that is intended for an audience other than the grader, then the communication should be appropriate for that audience.

Your goal should be to answer each question completely and appropriately. You should effectively and efficiently convey the information that answers each question. Your answers should average approximately one page (single-spaced).

Your name should not appear anywhere in your submission or in any way identify you as the author. If you believe you should refer to yourself in the context of an answer, use “FAP Candidate” instead of your actual name.

Questions 1–5

Scenario

You work for Sensible Insurance Company, a mid-sized insurance company whose core product is group term life. Sensible aims to grow and is trying to gain Mammoth Mart as a client. Mammoth Mart is a large employer in the U.S., and its addition will almost double the number of insured lives Sensible covers.

Sensible operates in all states in the U.S., but focuses on small to medium sized businesses concentrated in the Eastern U.S. Its current book of business has an average occupation mix of 20% blue-collar/80% white-collar. The average case size is 81 lives with no single group comprising more than 2% of the insured lives.

The CFO of Sensible is concerned that it may be growing too fast and has asked you to analyze the effect of adding Mammoth Mart as a client. Your student actuary has sent you the following information about Mammoth Mart:

x It has offices nationwide with over 500,000 employees.

x Approximately 60% of the employees are blue-collar, with the remainder being white-collar.

x As of today, all of its locations are in the U.S., but it is considering opening some Canadian locations in the next year or two.

x It is using a broker to negotiate prices and benefits with insurers.

Mammoth Mart wants a simple plan for its employees--all of them will be covered, and the face amount will equal the employee’s annual salary. However, instead of a typical one-year rate guarantee contract with premiums paid monthly, Mammoth Mart would like a three-year rate guarantee on the premium. It will pay the entire three years’ premium up-front based on its current workforce and salaries, with monthly adjustments based on increases or decreases to the covered salary amount.

Ideally, for such a large group we would want to use Mammoth Mart’s own experience to develop a rate, but this is the first time it has sought life insurance coverage. Therefore Sensible’s rate manual needs to be used.

A spreadsheet, which can be downloaded by clicking the “Excel File Group Term” link on the Download Page, has been prepared to assist you with the questions. Further description of the spreadsheet will be provided in the questions.

Question 1

(A) Using the existing ratemaking information provided in <Excel File Group Term, tab GT 1A>, determine the monthly premium per $1000 of covered salary for Mammoth Mart. Show your work in your answer.

(B) Due to Mammoth Mart’s request for an unusual payment arrangement you decide a monthly cash flow model should be built to better understand the financial implications. Your student actuary provides a model that you agree is sufficient for your immediate needs, located in <Excel File Group Term, tab GT 1B>.

You notice that using the assumed premium from (1A), the profit is greater than 3% of the claims. Briefly explain why this is and recommend a premium that matches the profit goal.

Premiums for both (A) and (B) (monthly cost / $1000 covered payroll) should be rounded to the nearest tenth of a cent.

(C) Mammoth Mart has been considering purchasing one of its rivals, Pacific Pro Shopper, and company officials are estimating the purchase would be effective at the start of month 30 in the current contract. This purchase would result in an additional $5B of monthly payroll covered for each of the remaining 7 months. Assume that the premium rate cannot be renegotiated for the additional payroll.

Using the monthly cash flow model located in <Group Term Life, tab GT 4>, briefly describe the impact the purchase would have on the premium that is collected by Sensible and the ending cash position compared to the original assumptions. As a baseline scenario, assume that the average claims rate remains level throughout the contract period.

For Questions 2-5, if a premium is needed in your calculations use the premium from 1(B).

Question 2

What are the key external factors that Sensible should consider when determining whether or not to pursue the Mammoth Mart account? How do these factors apply to this specific situation?

Question 3

Up until this point management has wanted you to use a 3.0% investment income rate. However, because investment income plays an important role in the case of Mammoth Mart you want to explore it in more depth. Using the historic data for different asset classes located in <Excel Group Term File, tab GT 3> recommend an investment strategy and investment income rate assumption.

Question 4

Before you give your final recommendation to the CFO regarding the Mammoth Mart contract, you decide it would be best to perform some sensitivity testing. Discuss the assumptions that you should consider when performing a sensitivity analysis. Explain why each of these assumptions is important to analyze. Do not perform the sensitivity analysis.

Question 5

Three years have passed and you have been asked to evaluate the Mammoth Mart deal. Mammoth Mart has expressed interest in a renewal quote.

Mammoth Mart’s experience has been summarized by your actuarial student in <Excel File Group Term, tab GT 6>. Note that the Canadian expansion has not yet occurred and talks with Pacific Pro Shopper have been delayed past the 30-month mark initially anticipated. Actual expenses for Sensible have been equal to those in the original assumptions.

(A) Evaluate Mammoth Mart’s results and profitability for Sensible. Are there any concerns about the results? Briefly discuss how well the rate guarantee worked for Sensible.

(B) In a memo written to an actuarial student who will be working with this contract going forward summarize your approach to the renewal using the control cycle as a framework. Include all five components of the control cycle as they relate specifically to this situation (Professionalism, External Forces, Define the Problem, Design the Solution, and Monitor the Results) as well as key renewal rating considerations, recommendations, or concerns you have.

Note: Be sure to save your spreadsheet calculations showing your work for the group term scenario. You will be prompted to upload this saved spreadsheet when you have completed the Interim Assessment.

Questions 6-10

Scenario

Your company, Awesome Benefits Company, sells the following individual disability insurance product.

x Level annual premiums are paid while healthy and under age 65. Premium rates are guaranteed and premiums are due at the beginning of the year

x Upon disability, a level monthly benefit is paid while the policyholder is unable to work (a status that is defined in the policy)

x Benefit payments commence after a 90 day waiting period (also called an elimination period)

x Benefit payments are 60% of salary and cease when the policyholder turns age 65, dies, or recovers

x The target market is highly paid professionals (such as doctors and lawyers) and corporate executives.

x The product is sold through insurance agents.

You have assigned your actuarial student, Joe, to build a pricing model. Joe has built the model in the Excel spreadsheet <Excel File Individual Disability>. Joe has made all of the baseline assumptions and selected initial premiums. The per-unit premium for each policy is set equal to the issue age - for example, a 42-year old with a $100,000 salary would pay $4,200 annually while a 30-year old with a $50,000 salary would pay $1,500 annually. Joe thinks this pricing scheme will help with marketing the product, because each year a customer delays buying this policy will lead to an increase in the level premium.

Given the recent economic volatility, Awesome Benefits Company has a conservative investment strategy. The investment strategy has three priorities; first it is required to hold at least a certain percent of its portfolio in liquid, short-term assets. The value can be found on the “Documentation” tab of the spreadsheet <Excel File Individual Disability>. Next, it wants to duration match assets and liabilities. Finally, it prefers to invest in United States government securities.

Awesome Benefit Company uses profit as a percent of premium as its primary profit measure. Using a discount rate of 5%, the required present value of distributable earnings as a percentage of premium is 9%. Management also desires an IRR greater than 12%.

For this assessment, you can ignore the claims paying ability of the company and any other plan design features not mentioned in this assessment. Do not audit the model.

Question 6

Now that the pricing model is built in <Excel File Individual Disability>, Awesome Benefit Company’s investment managers have asked you what type of assets should be purchased to back reserves and capital. You have been asked to assess and comment on its investment strategy.

(A) Using an interest rate of 5.0%, and the cash flows in the “Model Income Statement” tab, calculate the modified duration using paid claims as the liability cash flows.

(B) Given the available assets below, build an asset portfolio that best meets the requirements and preferences of the company’s investment strategy. Discuss the characteristics and implications of the choice of assets.

| Asset | Annual* Coupon Rate | Maturi ty | Price / Face |

| T-bill | N/A | 1 Year | 990 / 1000 |

| T-note | 2.90% | 10 Year | 1000 / 1000 |

| Corporate Bond | 3.20% | 10 Year | 1000 / 1000 |

| Corporate Bond | 4.10% | 30 Year | 1000 / 1000 |

| *Assumes coupons are paid once per year, at the end of the year |

(C) Senior management has determined that Awesome Benefit Company’s investment strategy should be even more conservative. You are now required to invest 100% of assets in government securities. Build a second asset portfolio, which is as close to duration matched as possible. Discuss the characteristics and implications of the choice of assets and compare it to the first portfolio.

Question 7

You need to review Joe’s pricing work (recall though that you do not have to audit the model). Use the <Excel File Individual Disability> model to run the entire population.

(A) Using Joe’s initial assumptions in the “cell info” tab, discuss the results of the pricing model in light of the desired profit measures. Recommend changes to the premium schedule if necessary.

(B) Assuming Joe’s premiums are maintained, assess Joe’s premium selection in light of the model results by age and gender, which are summarized on the “Output Summary” tab of <Excel File Individual Disability>. Is setting the per-unit premium proportional to the issue age appropriate? Justify your answer. Recommend changes if necessary.

(C) All of Joe’s pricing work has focused on one deterministic scenario. Assuming Joe’s premiums are maintained, perform a sensitivity analysis by changing key assumptions in the “cell info” tab and re-running the entire model. Key assumptions to include in the analysis are incidence, maintenance expenses, and interest rates. Which assumptions are most/least critical?

Question 8

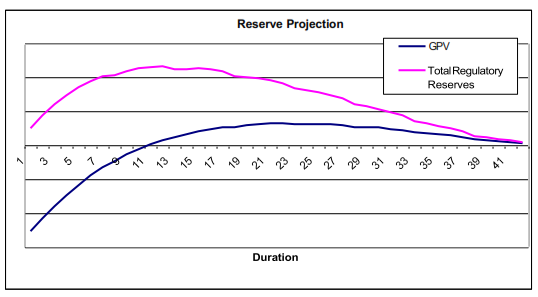

The new CFO doesn’t understand regulatory reserves and gross premium reserves. You created the following graph of regulatory reserves and gross premiums reserves by duration for the IDI projection.

(A) Explain the difference between these two reserves, including the how those differences produce this pattern of reserves by duration.

(B) Using the model output, calculate the gross premium reserve at the end of year 1 using a discount rate of 5% and the cash flows in the “Model Income Statement” tab.

(C) Awesome Benefit Company’s current regulatory reserves are rules-based. Discuss the differences when compared to a Principles-based valuation.

Question 9

In response to perceived abuse of disability income benefits by insureds, Awesome Benefit Company decides to offer a new product with a more restrictive definition of disability. This new definition of disability requires policyholders to be more severely disabled in order to qualify for benefits.

Briefly describe the general impact on claim costs / claim administration expenses, litigation costs, and reinsurance needs. Similarly, briefly list what data you would seek to quantify those effects.

Note: You will not upload the spreadsheet you used for this scenario.

Question 10

Awesome Benefits Company has completed the Failure Models and Effects Analysis (FMEA) process. For the individual benefit product the subject matter experts (SME) have identified the assumptions for each of the 5 scenarios shown below and the likelihood of the scenario occurring.

| Risk Scenario | Likelihood(%) |

| Credible worst-case | 5 |

| Pessimistic | 15 |

| Baseline | 60 |

| Optimistic | 15 |

Credible best-case 5

The assumptions for the 5 scenarios were run through the model. After completing the step of estimating the quantitative impacts, the SME's were concerned about the results from the moderately pessimistic and credible worst-case scenarios. Reinsurance was suggested as a risk mitigation strategy. The ERM team wanted to include the option of reinsurance prior to presenting results to senior management. An offer for reinsurance was received. The model was adjusted for reinsurance and re-run.

| Risk Scenario | No Reinsurance | Reinsurance |

| Credible best-case | 1 | 6 |

| Optimistic | 2 | 7 |

| Baseline | 3 | 8 |

| Pessimistic | 4 | 9 |

Credible worst-case 5 10

The model income statements have been provided to you in <Excel File Reinsurance> to prepare for the senior management report. The table above indicates the scenario in the spreadsheet for the described situation. Generate an executive summary of the data that is easy to understand and present. Make a recommendation as to whether the reinsurance offer should be chosen. Justify your recommendation.

Note: You will not upload the spreadsheet used with this question.

Questions 11-12

Scenario

Warren Peace (WP) winery is a family-owned company which manufactures, markets and distributes fine wine. The winery is located on a 60-acre vineyard in Northern California, USA which is where WP grows grapes and manufactures its products. WP has a history and heritage of fine winemaking for over 30 years. WP sells several types of wine produced from its own locally grown grapes.

Generally, WP produces two vintages of wine, a high quality vintage wine which sells at a premium, and a lower quality brand name wine. From time to time, WP purchases grapes from other vineyards in Northern California and imports grapes from France, Italy, Argentina, and Canada.

The current Chief Executive Officer is Warren Peace III and the Board of Directors consists of 5 members of the Peace family. The company has 10 total permanent employees.

WP’s company objectives include:

x Produce quality wines at a reasonable price

x Conduct business with integrity and honesty

x Have a passion for wine

x Maximize company value through increasing profit margins

Distributable profits provided by WP over the past few years have ranged from $0 to $1,000,000. As a result of this volatility, WP is in the process of adjusting the company objectives to include an increased risk management focus. To help with this task, WP has hired Al Nino to develop a risk management framework for WP. You are part of a team of actuarial students working for Al.

Warren has asked Al to recommend an ERM framework for W P winery. One of your fellow actuarial students has drafted the following memo and has asked you to review it before sending it to Al.

TO: Warren Peace III

FROM: Al Nino, Risk Consultant

RE: WP Winery Enterprise Risk Management (ERM) Framework

Introduction

This memo will lay out considerations for the development of an enterprise risk management strategy for Warren Peace W inery (W P).

The risk management philosophy of W P should:

x Identify and successfully manage risks that present good risk/reward opportunities

x Balance demands of various stakeholders

x Encourage a risk management culture throughout the company

x Quantify risks and strictly manage to an identified risk tolerance

An understanding of enterprise risk management should be embedded throughout the organization. The CEO is ultimately responsible for the key risks, but responsibilities will be delegated to the Chief Risk Officer (CRO) and the ERM committee.

x CRO: responsible for providing the CEO with a written risk report on a quarterly basis, which includes a status report on risk tolerances and risk appetite. Currently there is no CRO on staff at WP.

x ERM Committee, which is a subset of the work force and includes equal representation from manufacturing, marketing, and distribution. This committee is responsible for reviewing and recommending risk tolerance and risk appetite.

Risks Identified

We have done a comprehensive review of W P’s business processes and global wine market conditions and have identified the following risks:

x Competitor risk / loss of key customer – This is the loss of a primary distribution partner to competing wineries.

x Production risk – This is the loss resulting from unexpected equipment repairs or replacement.

x Counterparty credit risk – WP sells its products to various wholesalers throughout the world. This is the risk of financial loss resulting from counterparty default or delay of payment.

x Market risk – Unexpected changes in external markets impacting the cost of producing wine.

x Product / pricing risk – Unexpected changes in external markets impacting the price of wine.

x Interest rate risk – WP has variable rate loans. This is the risk of increasing interest rates affecting the financing costs.

x Labor expense risk – This is the risk of adverse changes in the cost of labor.

x Business risk – This is the risk of losses resulting from general business practices

and from political, regulatory, and legislative issues.

x Reputation risk – This is the risk of losses due to negative publicity or failure to uphold a good reputation.

x Operational risk – This is the risk of losses arising from failures in people, process, technology.

x Weather / suboptimal growing condition risk – This is the risk of losses due to poor growing conditions leading to poor wine quality and low yields.

Risk Quantification

We are proposing the following framework to manage and monitor the above identified risks.

WP should develop well-defined risk limits and metrics that are regularly and consistently monitored and enforced. They should also be reviewed regularly for needed updates. The CRO will be responsible for developing and maintaining appropriate models to manage and monitor risk. One of the key modeling outputs is distributable cash flow under both deterministic risk scenarios and more advanced scenario testing such as stochastic simulations.

The baseline company value is the present value of distributable cash flows over a 10-year time horizon, discounted at the hurdle rate. When assessing the various risks, multiple scenarios are combined using correlation matrices.

A summary of the key metrics is included in the table below.

| Enterprise Risk Metric | Definition | Frequency of Review |

| Company Value (CV) | Average Present Value of Distributable Cash Flows | Annually |

| Company Value at Risk (CVR) from all risks | CV at the 5th Percentile | Annually |

| CVR from Standalone Risk (SCVR) | CV at 10th Percentile | Annually |

Risk Tolerance

In defining WP’s risk appetite, there should be a target risk metric and a maximum risk metric.

x Target risk metric -- this is where WP is most comfortable with overall risk/reward relationship.

x Maximum risk metric -- this is the maximum amount of risk WP is willing to take. If the risk metric reaches the maximum, then there needs to be action to reduce the exposure.

One of the objectives of W P is to maximize company value through increasing profit margins. This is accomplished through increasing Company Value while managing to the specified risk tolerances.

| Risk Metric | Target | Maximum |

| CV | Increase Company Value while managing to other risk tolerances | N/A |

| CVR | 15-25% of Baseline CV | 35% of Baseline CV |

| SCVR | 5-10% of Baseline CV | 20% of Baseline CV |

Conclusions and Recommendations

This memo has outlined an enterprise risk management strategy for W arren Peace W inery. This memo should be updated and reviewed on an annual basis.

Currently, W P has no CRO. In order to embed a risk management culture throughout the organization, this position needs to be filled as soon as possible. The CRO will be responsible for organizing the ERM committee.

The company objectives for W P should be adjusted to specifically cite risk management. It is recommended that an additional objective be added.

Question 11

Warren Peace has asked your team to make a presentation to the Board of Directors to describe the ERM process. You will hand out a summary of the benefits of ERM. Al has asked you to draft the handout and to include the following:

x Why should WP implement an ERM process?

x What are the benefits to WP’s major stakeholders (The Peace family, WP’s other employees, wholesale distributors, business partners, creditors, and customers)?

x Who will be responsible for the ERM process?

x How will a Corporate Value ERM framework assist in WP’s business decision making process?

x How will an ERM framework address the Board’s concerns?

The presentation should be written in bullet point form summarizing the main ideas.

Question 12

Several months have passed and WP has adopted a risk management framework based on your recommendations. Melissa Peace, a member of the Board, is the new Chief Risk Officer (CRO) and an ERM Committee has been created. The members of the ERM Committee include the CRO, the General Manager, and the head winemaker.

The ERM Committee has identified the following as the key risks to WP’s CV:

x Competitor risk / loss of key customer

x Weather / suboptimal growing condition risk

x Production risk

The ERM Committee has asked for your assistance in evaluating several proposed risk mitigation strategies. These have been suggested to align WP’s risks within the limits proposed by the adopted risk document. To assist in determining the effectiveness of the suggested strategies, your team constructed a stochastic model. It was used to identify and quantify the key risks for the Board and incorporates all aspects of income and expenses. The risk mitigation strategies include:

x Sales Contracts: Enter into a sales contract with your primary distributor. The sales contract will ensure purchase of a fixed amount of wine in exchange for a discounted price over the next 10 years.

x Diversification: Lease out a portion of WP’s vineyard and use the funds to rent space in

vineyards in other locations. There will be additional costs to transport grapes from the new vineyards to the main winery in Northern California.

x Update Equipment: Invest in new equipment and maintenance workers to reduce the likelihood of expensive repairs to equipment.

1000 scenarios of the stochastic model were run to determine the risk metrics. The results of the stochastic model are summarized in the Excel worksheet <Excel File Winery ERM>.

Considering the Risk Document adopted by the ERM Committee, evaluate the effectiveness and appropriateness of each of the above risk mitigation strategies.

Note: You will not upload the spreadsheet used with this question.

Questions 13-14

Questions 13-14 are independent of each other and are not linked to a shared scenario.

Question 13

You work with the pricing actuary at Cash for Claims, a large P&C insurer. The actuary is currently on holiday and the CEO has come to ask you some questions based on the most recent pricing analysis.

(A) The rates proposed by the pricing actuary were not in the range the CEO expected. The rates will take effect July 1, 2016 for one-year policies and will be in effect for one year. In 2013 there was a large storm resulting in an additional 230 storm related claims averaging $30,000 each. Each of these claims was from one unit of exposure. The company was able to settle 40% of all total claim liabilities relating to those claims within the year with the remainder being paid out the following year. No claims are expected beyond development year 4.

The CEO has asked you to verify the total projected loss costs excluding potential large storm losses for 2016. The prior actuary determined trend factors using the least squares method and determined the projected loss cost based on the loss cost for 2014 and 2015 with weightings of 40% and 60% respectively. The data and underlying model are in the Excel worksheet <Excel File GI>.

Your response should include the projected loss costs for 2014 and 2015. Please show your work.

(B) After sharing the results of your previous analysis, the CEO commented that the initially proposed rates per $1,000 have increased much higher than both the trend you had determined and the overall industry trend for losses. Discuss the factors that may be driving this. What possible actions could the insurer take to reduce rates for next year and

beyond? What are the considerations that would need to be made with these actions?

Question 14

You are an actuary with Mayhem Consulting. Quality Insurance, a small insurance company that is a new client, has provided you with detailed policyholder data for a block of universal life insurance policies and asked you to prepare a reserve estimate using that data. You begin reviewing the data and notice some irregularities. A sample of the data provided is shown in <Excel File Universal Life>.

(A) According to ASOP 23, what should you consider prior to using the data? Discuss problems that you see with the data and how the considerations apply.

You discuss the irregularities with Quality’s Chief Financial Officer (CFO) and he is able to provide you with an updated data set. However, the CFO says that the policy administration system automatically assumes all policyholders are male and they haven’t been able to fix the system to correctly track gender. You continue with your reserve estimate assuming all policyholders are male because you know that assumption does not conflict with any laws or regulations. You believe that reserves may be overstated by as much as $2,000,000 due to that assumption.

(B) Prepare a disclosure statement regarding data quality that you would include in your documentation.

(C) After you have prepared your reserve estimate and disclosure statement, Quality’s CFO asks you to change some of the data in order to reduce the reserve amount. How does the Code of Professional Conduct apply in this situation?

Note: You will not upload the spreadsheet used with this question.

Important Note about Inserting Tables

If you need to insert Excel tables into your document, then you must follow the instructions below to copy and paste it from Excel into your Word document (do not “Paste as Picture” or “Insert Object”). Do not use Word’s “Insert, Table, Excel Spreadsheet” function, since this will not paste your table in the correct format. Pasting a table as a picture or as an object will be construed as an attempt to defeat the SOA’s plagiarism scanning process and will result in an automatic disqualification of your submission. (Graphs pasted as pictures are not affected by this requirement.) If you cannot get the pasted table to fit on the page, you can right-click on it and select “AutoFit to Window”.

Steps for pasting tables (for Windows versions of Word/Excel):

1. Copy the cells from your Excel spreadsheet. If you use the Copy command on the Home tab, do not select the option to “copy as picture”.

2. In your Word document, turn on the “Show/Hide Paragraph Marks” feature.

3. In your Word document, right-click where you want to insert your table.

4. In the menu that pops up, under Paste Options, select any of the first four options:

a. “Keep Source Formatting”

b. “Use Destination Styles”

c. “Link & Keep Source Formatting”

d. “Link & Use Destination Styles”

5. If you have “Show/Hide Paragraph Marks” turned on, you should see small circles at the end of each cell in your table. This is how you can know whether or not you have pasted your table correctly.

Steps for pasting tables (for Mac versions of Word/Excel):

1. Copy the cells from your Excel spreadsheet. If you use the Copy command on the Home tab, do not select the option to “copy as picture”.

2. In your Word document, turn on the “Show All Nonprinting Characters” feature.

3. In your Word document, right-click where you want to insert your table.

4. In the menu that pops up, click Paste (not Paste Special).

5. If you have “Show All Nonprinting Characters” turned on, you should see small circles at the end of each cell in your table. This is how you can know whether or not you have pasted your table correctly.