Solved: Dan's Analysis of East Coast Yachts' Cash Flow

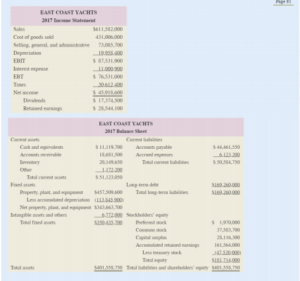

After Dan's analysis of East Coast Yachts' cash flow (at the end of our previous chapter), Larissa approached Dan about the company’s performance and future growth plans. First, Larissa wants to find out how East Coast Yachts is performing relative to its peers. Additionally, she wants to find out the future financing necessary to fund the company’s growth. In the past, East Coast Yachts experienced difficulty in financing its growth plan, in large part because of poor planning. In fact, the company had to turn down several large jobs because its facilities were unable to handle the additional demand. Larissa hoped that Dan would be able to estimate the amount of capital the company would have to raise next year so that East Coast Yachts would be better prepared to fund its expansion plans. To get Dan started with his analyses, Larissa provided the following financial statements. Dan then gathered the industry ratios for the yacht manufacutring industry. Required:

1. Calculate all of the ratios listed in the industry table for East Coast Yachts.

2. Use the ratios that you calculated to compare the performance of East Coast Yachts to the overall industry. Your analysis should include whether East Coast Yachts’ performance should be viewed as positive or negative relative to the industry. You will also want to include a brief statement regarding the impact the ratio has on the overall company.

a. Example: East Coast Yachts Inventory turnover ratio is (431,006,000/20,149,650) 21.39 times. This would be viewed positively because the company would be operating in the upper quartile of the yacht industry. This means that East Coast Yachts does not have a large inventory of boats that need to be sold because customers are purchasing them when they are available. Not having a large inventory of boats to sell means that East Coast Yachts should be able to: reinvest the cash they receive from sales back into the company for future growth, pay down debt, or provide a return to investors. It is important to remember that not having a large inventory of boats to sell may mean that

boats are not available when customers want them so the company may be missing opportunities as well.

3. Calculate the sustainable growth rate for the company.

4. Assume that East Coast Yachts is planning on growing by 20% in 2018. Create the proforma income statement and balance sheet using the following assumptions:

a. The company will not issue additional equity during the year

b. The company will not buy back any equity during the year

c. The Payout ratio will remain constant

d. The following costs vary with sales:

i. Cost of goods

ii. Selling, general, and administrative

iii. Interest

e. The Tax rate is constant

f. The depreciation rate can be calculated by dividing depreciation expense by beginning net property plant and equipment

i. Beginning net property plant equipment (NPPE) = 2017 Ending NPPE + Depreciation Expense

g. The new depreciation expense will be calculated by multiplying the 2018 estimated NPPE by the depreciation rate

i. 2018 NPPE = Ending 2017 NPPE + Fixed Asset purchases

h. The company is operating at full capacity. Adding additional capacity will require an investment of $95,000,000 in fixed assets

i. The following balance sheet accounts vary will sales:

i. Cash

ii. Accounts Receivable

iii. Inventory

iv. Other

v. Accounts Payable

vi. Accrued Expenses

j. Long-Term Debt will be adjusted to make everything balanceWhat is the External Financing Required for the 20% growth plan?

5. Assume the company is unwilling to take on additional debt to reach its 20% growth target. What steps could the company take to reach the goal of growing by 20% growth while keeping debt constant?

6. Given your analysis what are your recommendations and conclusions about the feasibility of the East Coast Yacht expansion plan?

Solution

[sdm_download id="1503" fancy="0"]

[sdm_download_counter id="1503"]

Required:

1. Calculate all of the ratios listed in the industry table for East Coast Yachts.

2. Use the ratios that you calculated to compare the performance of East Coast Yachts to the overall industry. Your analysis should include whether East Coast Yachts’ performance should be viewed as positive or negative relative to the industry. You will also want to include a brief statement regarding the impact the ratio has on the overall company.

a. Example: East Coast Yachts Inventory turnover ratio is (431,006,000/20,149,650) 21.39 times. This would be viewed positively because the company would be operating in the upper quartile of the yacht industry. This means that East Coast Yachts does not have a large inventory of boats that need to be sold because customers are purchasing them when they are available. Not having a large inventory of boats to sell means that East Coast Yachts should be able to: reinvest the cash they receive from sales back into the company for future growth, pay down debt, or provide a return to investors. It is important to remember that not having a large inventory of boats to sell may mean that

boats are not available when customers want them so the company may be missing opportunities as well.

3. Calculate the sustainable growth rate for the company.

4. Assume that East Coast Yachts is planning on growing by 20% in 2018. Create the proforma income statement and balance sheet using the following assumptions:

a. The company will not issue additional equity during the year

b. The company will not buy back any equity during the year

c. The Payout ratio will remain constant

d. The following costs vary with sales:

i. Cost of goods

ii. Selling, general, and administrative

iii. Interest

e. The Tax rate is constant

f. The depreciation rate can be calculated by dividing depreciation expense by beginning net property plant and equipment

i. Beginning net property plant equipment (NPPE) = 2017 Ending NPPE + Depreciation Expense

g. The new depreciation expense will be calculated by multiplying the 2018 estimated NPPE by the depreciation rate

i. 2018 NPPE = Ending 2017 NPPE + Fixed Asset purchases

h. The company is operating at full capacity. Adding additional capacity will require an investment of $95,000,000 in fixed assets

i. The following balance sheet accounts vary will sales:

i. Cash

ii. Accounts Receivable

iii. Inventory

iv. Other

v. Accounts Payable

vi. Accrued Expenses

j. Long-Term Debt will be adjusted to make everything balanceWhat is the External Financing Required for the 20% growth plan?

5. Assume the company is unwilling to take on additional debt to reach its 20% growth target. What steps could the company take to reach the goal of growing by 20% growth while keeping debt constant?

6. Given your analysis what are your recommendations and conclusions about the feasibility of the East Coast Yacht expansion plan?

Solution

[sdm_download id="1503" fancy="0"]

[sdm_download_counter id="1503"]