KIA Motors Group

Founded in 1944, Kia Motors Group is the oldest manufacturer of motor vehicles in Korea. Currently, the company sells more than 1.4 million motor vehicles per annum and undertakes motor vehicle assembly operations in 8 nations (Kia Company, n.d.). These fleets of vehicles are serviced and sold via a network comprising of more than 40,000 employees and 3,000 distributors in 172 nations. The company commands USD 172 million in annual revenue.

Risk Factors and KIA Motor’s Global Operations

- Foreign Exchange Risks. KIA Motors Group holds derivative contracts as hedging instruments to manage highly risky foreign exchange transactions (Kia Company, 2017). Foreign exchange risks can impact KIA motors in a variety of ways, including, the possible value differences in its end of the year financial reports. There could be sharp changes in the value of assets and liabilities due to foreign exchange fluctuations.

- Volatility in financial markets. The company aims to improve sales and profitability, and accelerate its future preparation in order to overcome this challenge. Volatility in financial markets, including exchange rates and currency fluctuations affects KIA’s expected cash flows, thereby, impacting on its performance. This happens through changes in the domestic value of foreign currency denominated costs as well as the available terms of competition for its international activities.

Management Discussions of Global Issues that Impact the Business

Kia motors CEO Han-Woo Park indicates that in 2017, the company experienced an extremely fierce competitive landscape due to slow growth in its major markets, especially caused by the protectionism spread around the globe and domestically due to a strong Korean Won. This led to an approximately 8.6% decrease in sales from the previous year. As Robertson (2017) confirms, the statement by the CEO is true and the automobile industry is in threat from the globalization caused protectionism. Citing other automobile firms experiencing similar challenges, Robertson indicates that border taxes on the importation of cars will definitely impact the global motor industry. Companies are shifting their global strategies, for instance, BMW for the first time announced in 2017 that it will retool its South African factory to start producing the X3 sport-utility car.

Accounting Policy of KIA Motors Group

- The main accounting policy for the company are on the basis of consolidation, business combinations, investment in joint associates and ventures, inventories, cash and cash equivalents, non-derivative financial assets, and non-current assets held for sales.

Debit and Credit Transaction

| Debit (Dr) | Credit (Cr) | ||

| 31 December, 2018 | 31 December, 2018 | ||

| 590, 143 | |||

| 117,257 | |||

| Total | 572,886 |

Foreign Exchange Rate Exposure.

- The firm provides both a discussion and tables to present the financial impacts of foreign exchange to its activities.

- It is primarily exposed to the U.S Dollar and the Euro and its functional currency is the Korean Won.

- According to the firm, they constantly evaluates the possible FX risks based on their guidelines for foreign exchange transactions policy, after which it can be involved in foreign currency contracts to hedge currency risks. As of December 31, 2016 and 2017 respectively, the group saw a 10% increase or decrease in FX rates against fluctuant EUR and USD.

Figure 1: South Korea Figure 2: USA

| USA | South Korea | |

| Price | $15,390 - $16,490 | $7,700 – $8,200 |

| PPP | $12143.47 | $49803.50 |

| Current Exchange | 1 USD = 1,172.73 S. Korean Won | 1 S. Korean Won = 0.00085 USD |

Taxation (values in millions of Korean Won)

Income tax =

Income before tax = 192,354

Effective tax rate = 15.09%

Profit before tax = 1,140,053

Corporate tax in South Korea = 25.00%

The company uses a much lower tax rate compared to the South Korean Corporate tax rate of 25%. No any other tax haven has been indicated in the FY report ending December 31, 2017.

Analysts Discussions on the Firm’s International Operations

In-Soo Nam indicates that according to analysts, KIA Group in 2017 had no easy market and the company was poised to experience an uphill battle against major automobile firms like Toyota (MarketScreener, 2017). He further notes that the value of the Korean Won is weak in comparison to dollars, and as such, smaller firms, especially in the U.S will gain market share at the expense of KIA motor group.

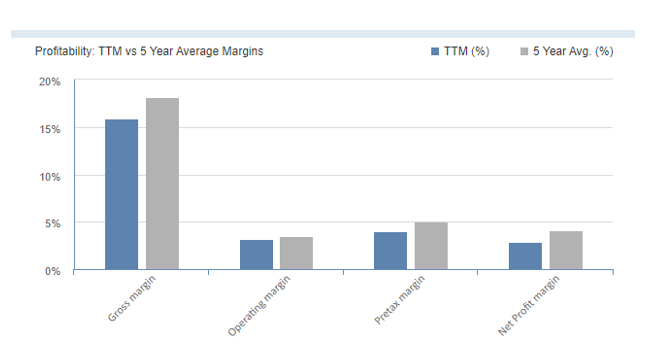

DuPont Analysis

| 2016 | 2017 | |

| 2.48% | 2.77% | Net Profit Margin |

| 1.04 times | 1.02 times | Total Assets Turnover |

| 1.91 times | 1.95 times | Equity Multiplier |

| 4.93% | 5.51% | DuPont ROE |

Kia Stock Prices and P/E Ratio (Values in KRW)

| Date | Open | High | Low | Close | Adj Close | Volume | P/E |

| 12/1/2015 | 52500 | 57100 | 50500 | 52600 | 47537.02 | 16881487 | 801,952.00 |

| 12/1/2016 | 37400 | 39800 | 37000 | 39250 | 36234.11 | 14863243 | 571,075.00 |

| 12/1/2017 | 33650 | 34400 | 32000 | 33500 | 31811.83 | 14969999 | 138,774.00 |

| 12/1/2018 | 30900 | 34200 | 29600 | 33700 | 32791.91 | 16249408 | 116,886.00 |

| SAIC Motor Corporation Limited (Values in CNY) | |||||||

| Date | Open | High | Low | Close | Adj Close | Volume | P/E |

| 12/1/2015 | 19.05 | 22.1 | 19.01 | 21.22 | 16.96567 | 491760150 | 785,344.00 |

| 12/1/2016 | 25.44 | 26.17 | 22.56 | 23.45 | 20.03312 | 717021441 | 807,785.00 |

| 12/1/2017 | 30.98 | 32.52 | 30.55 | 32.04 | 28.86843 | 414034101 | 10,828.00 |

| 12/1/2018 | 25.25 | 27.88 | 24.13 | 26.67 | 25.35374 | 468649151 | 865,319.00 |

References

Kia Company. (n.d.). Kia Company. Retrieved from https://www.kia.com/mt/about-kia/kia-company/

Kia Company. (2017). The Future: Kia motors annual report 2017. Retrieved from file:///C:/Users/Chris/Downloads/2017%20Annual%20Report.pdf

MarketScreener. (2017, January 3). Hyundai, Kia face another tough year -- WSJ. Retrieved from https://www.marketscreener.com/HYUNDAI-MOTOR-CO-6492384/news/Hyundai-Kia-Face-Another-Tough-Year-WSJ-23634379/

Robertson, J. (2017, February 8). Why carmakers fear protectionism. Retrieved from https://www.bbc.com/news/business-38570387