Strategies Used to Create Shareholder Value

Introduction

Managers and business executives have maintained focus on the quarterly earnings of a firm as the main drivers for the firm’s value in the stock market. Despite being of importance in identifying an organization’s stock market surprises, they are not the main drivers. The key to an organization’s higher stock market value is the real corporate performance, where the funds available for corporate management drives a higher return the can be achieved elsewhere. A higher real corporate performance increases a firm’s share prices and dividends, and thus, increasing the shareholder’s return. To create shareholder value, managers should have an adequate understanding of a business’s key value drivers (Mzera, 2012). Values drivers are variables that have considerable effects on the value of an organization. This research looks into the strategies used in the creation of shareholder’s value based on the article by Akroush, (2012), “An empirical model of marketing strategy and shareholder value: A value-based marketing perspective” and Rappaport (2006), “Ten ways to create shareholder value”.

Currently Used Initiatives in Shareholder Value Creation

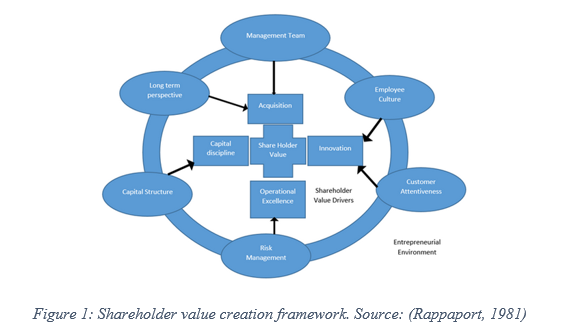

The current volatile and complicated business environment has created a shareholder value business philosophy, where a firm evaluates its success by inspiring its stockholders. The stakeholder value approach is aimed at increasing the value of an organization by growing its stock market value, raising the firm’s earnings, and increasing the frequency and the amount of its dividends paid (Rappaport, 2006). Based on this approach, corporate managers are in more pressure to regularly measure, manage, and report shareholder value creation. As such, creating value for stockholders has become an extensively recognized corporate initiative and objective. The figure presented below highlights the framework for the creation of stockholder value.

- Utilization of assets that maximize value

This research has recommended this method since it can allow hotels to lower the capital they consume and increasing shareholder value through focus on high value-adding maneuvers like marketing, design, and research. Similarly, they can outsource low value-adding maneuvers like manufacturing if they are cheaply and reliably available from other sources. This method has successfully been employed by the Marriot International and Hilton Hospital hotels, which are hotel corporates that manage their businesses without owning them and Apple Computers, which has its design for the iPod product in California and manufacturer in Taiwan.

- Making strategic decisions that aim to maximize the hotel’s expected value

Organizations tend to compare and evaluate their strategic decisions based on their estimated influences on the reportable earnings. Though, this should be done against the firm’s expected incremental value of the predicted future cash flows. Utilization of this method to the hotel business should highlight the best shareholder value-creating strategy and its sensitivity to the most likely scenario of possible shifts in the regulatory environment, competition dynamics, among other variables. Apart from the hotel industry, the method is feasibly applicable in the tourism and beverage sector.

- Acquire assets that maximize its expected value

Organizations will create value through their daily operations. The impact of a major acquisition, on the other hand, affects the value of an organization faster than all other activities. Hotel companies should consider their earnings per share ratio before being involved in any M&A deal. It is stipulated that when the price/earnings multiple of the acquiring firm is greater, then EPS increases (Sinha, 2010). To create higher shareholder value, hotels should acquire a business with lower price/earnings multiple. This method can be utilized in any other industry.

References

Akroush, M. N. (2012). An empirical model of marketing strategy and shareholder value: A value-based marketing perspective. Competitiveness Review: An International Business Journal, 22(1), 48-89.

Mzera, U. J. M. (2012). The effect of strategic value-based management on the performance of organizations in Coast Province, Kenya. International Journal of Business and Social Science, 3(16).

Rappaport, A. (2006). Ten ways to create shareholder value. Harvard Business Review, 84(9), 66-77.

Sinha, N., Kaushik, K. P., & Chaudhary, T. (2010). Measuring post-merger and acquisition performance: An investigation of select financial sector organizations in India. International journal of Economics and Finance, 2(4), 190-200.