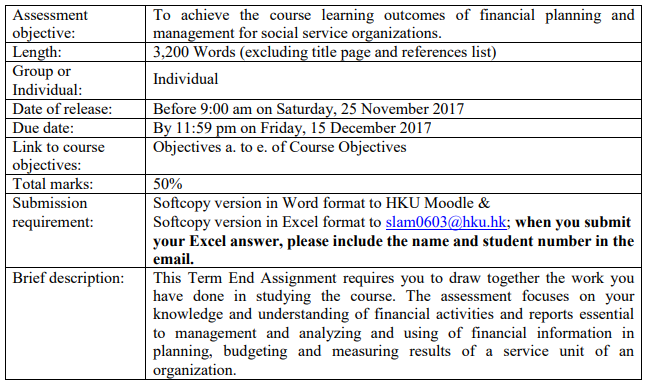

SOWK 6156: Financial planning and management for social service organizations

Instruction to students:

You are required to read the following instructions carefully and seek clarifications from course teacher immediately if necessary.

Task

The purpose of the assessment on this Term End Assignment is to develop knowledge of some of the key concepts and practices to good financial management addressed in the course unit and to demonstrate your knowledge and understanding of financial activities and reports essential to

management and your skills of analyzing and using of financial information in planning, budgeting and measuring results of a service unit of an organization.

You are given a total of THREE tasks to deal with and answer.

The marks and specific requirements are set at end of each task. You should follow the required instructions to provide answers of each task in the Term End Assignment. Marks will only be awarded for the answers to those tasks in the Term End Assignment.

You have 3,200 words to reflect on your effectiveness of writing skills, knowledge and understanding of the course. You can draw your answers by the reading you have done from the material on study texts, on-line journal articles and reference study of the course. When you draw any references on the published articles, study guides and texts and so on, you need to follow the referencing guidelines. Marks will NOT be given for if you fail to do so.

While you are at liberty to write below the ceiling of 3,200 words, it is advisable that you script may not reach the acceptable and competent standard of the course requirement if the total number of words is less than 2,500. Please observe the following rule:

The excess of 3,201 words or above: -5% of total marks of 50%

There is NO penalty of marks for 2,500 words or below, but the final grade would be affected by the competent standard of the course requirement.

You are given a template for the submission of your Term End Assignment and should make use of it. Marks will be deducted if you do not follow the submission criterion.

There will not be any calculation part in this assignment; however, you are at liberty to provide any calculations or figures which you think they are useful and meaningful to illustrate the subject areas and to support your answer. The calculations part should be attached to the Term End

Assignment and they are not counted towards the word limit.

Regarding the written assignment, it should be answered in the typed A4 paper in Word file with the file title. Format requirements are 12 font; 1.5 spacing; portrait format; number all pages and section

headings.

Appendices for elaborating the subject matter and references are acceptable and will NOT count in the word limit – however make sure that you refer to the key content in the body of your answer, as marks will only be awarded in the main sheets. All words (excluding the title page, contents page, appendices AND references list) are included in the word count. Write down the total words count in your script for submission. Late submission of the script will follow the University rules and regulations.

Important note for the submission of completed script – You need to ensure including the following:

a. Term End Assignment script – HKU Moodle System

b. Answer sheet of Appendix B – email address: slam0603@hku.hk

Case Study: Hong Kong Social Services Society

Background and history

Hong Kong Social Services Society (“HKSSS”) is a multi-disciplinary social services organization which was established in early 1970s. Its establishment was a response to the growing population in Hong Kong and its increased welfare needs. At the beginning, HKSSS only provided some

community services to meet local district needs and the first centre commenced service in 1972.

Throughout the last forty years, HKSSS has extended its services and now provides services in areas of Elderly, Rehabilitation, Children and Family services. To address the newly social service needs, HKSSS has started its Social Enterprise (“SE”) four years ago and now operates one SE to offer

employment to those underprivileged group, single parents and deprived families. It is planning to launch a self-financed service of tuition and after school care service to children in next school year 2018/19 in one of its service divisions. At present, 26 service units: subvented, self-financed and SE under the three service divisions of Elderly, Rehabilitation, and Children and Family have been developed all over Hong Kong.

Following the service re-engineering in 2014 with the funding support from Social Welfare Development Fund (SWD Fund), HKSSS has decentralized its administrative, human resources, and finance functions to its services. Each service has appointed a Senior Service Manager to be responsible for the particular service and supervise his/her service as well as the administrative support. Senior Service Managers have the authority to hire and dismiss staff under their control and are responsible for their service results including the finances.

Financial policy and planning

Since HKSSS has delegated the entire finance function of service to its Senior Service Managers, it requires each Manager to be responsible for the following financial policy:

To ensure that the books of accounts are prepared to confirm to sound accounting principles and practices.

To enable management to obtain accurate and timely financial reports on regular basis, thus ensuring and promoting sound financial management is in place.

To ensure a proper internal control system in place on services so as to safeguard the organization’s assets and resources.

To ensure correct and accountable use of various designated and restricted funds and other resources.

The financial planning of HKSSS requires each service has to strive for the balancing of its bottom line without using the accumulated surplus when planning and using its resources. In other words, HKSSS requires each service has to achieve a break-even of its finances. It also encourages each

manager to solicit other donations and fund grants to support both its subvented and self-financed services as far as reasonably practicable.

Financial performance measurement

To better transform its traditional financial performance measurement into the one based on strategic management and goals, HKSSS has adopted the consultants’ recommendations to implement the Balanced Scorecard as the organization’s performance measurement framework about three years

ago. All senior staff members including Senior Service Managers have attended the relevant seminars and workshops, mastered the relevant technique of how to evaluate and measure the performance of their services from four perspectives: customer, internal business processes, learning and growth and finance.

Internal controls

HKSSS has proactively adopted and implemented an internal control system across its services about three years ago. It is based on the COSO Framework which helps the organization reduce the risks occurred in operations and detect the operational weaknesses. It has installed a new sophisticated financial management system which has strengthened the controls over receipts, payments, accounting processes and fixed assets. With the aid of the COSO Framework and this sophisticated financial management system, Head Office (“HO”) works on a leaner staff system, delegates all routine service operations to its Senior Service Managers and charges of its entire HO overheads across all services to reflect costs incurred in supporting these services. HO reviews financial performance of each service and discuss with Senior Service Managers on how to improve the sound financial management practices periodically.

Your role and responsibility

You have been promoted to the post of Senior Service Manager for about a year and supervise the Children and Family Services division which comprises of three integrated service units: HKSSS Hong Kong Island Children and Family Services, HKSSS Kowloon East Children and Family

Services and HKSSS Easy one-stop service. Each service unit has a Service Unit-in-charge and a number of professional and front-line staff to assist you in operating and fulfilling service needs and mission and values of HKSSS. The central administrative support for services is located in one of the integrated service units: HKSSS Hong Kong Island Children and Family Services where you are working with. The division is planning to launch a self-financed service of tuition and after school care service to children in next school year 2018/19.

PART A

You are informed by Chief Executive Officer (CEO), the organization head of HKSSS that there will be the organization’s Board meeting in the coming late December 2017 and one of the agenda items is to carry out a mid-year financial review of services. The CEO has instructed each Senior Service

Manager to submit a service report which includes financial summaries on service analysis and performance for the Board review and comment. You have asked your Assistant Accounting Officer to prepare the required financial information and service data which may assist you in writing the

report for the Board meeting purposes.

TASK A: (Total: 15%)

(a) You are provided with the financial statements (Appendix A_Financial Statements and Notes) covering the period of April to end of September 2017, i.e. 6 months result of your service and a cash flow forecast statement covering the period of October 2017 to March 2018. Study the financial statements, analyze the financial data and write a service report on financial performance of your service. Your report should cover major financial issues including cash position that you have observed and focus on any issues that you would like to bring to the attention of your CEO. In your report, you may make suggestions on how to improve your services if any. (Note to students: you can draw references on the additional information provided by your Administrative Officer and Assistant Accounting Officer and make any assumptions in your report if needed.) (9%)

(b) Meanwhile, when you review the financial statements, you note that the Assistant Accounting Officer has done some accounting adjustments to the financial statements. These include the prepayment of programme fees $25,625 for programmes organized in the next two months; the accrual of utilities on electricity and water $1,875; the accrual payment of vendors on

stores and equipment $22,463; the depreciation of some fixed assets purchased in the last few years $33,475 and the provision of a doubtful debt $800 from a client who has defaulted in repayment for more than 90 days in Miscellaneous. Since HKSSS accounting guidelines have provided that service units’ accounts for SWD purposes have to be prepared for the cash

basis. You are going to write a report to CEO explaining the nature of such prepayment, accrual, depreciation and provision of income and expenditure in your service unit accounts and their discrepancies when you finalize the accounts for the accrual basis. (Note to students: you are not required to re-work the financial figures of any prepayment, accrual, depreciation or provision of income and expenditure in Appendix A_Financial Statements and Notes, but you need to demonstrate of how such adjustments would affect the Board’s understanding of financial result when using the cash basis.) (6%)

To facilitate the writing of financial and service performance of Children and Family Services division to your CEO, your assistant, the Administrative Officer has provided the following additional information for your attention:

- Service scope

Since January 1, 2010, the service has been providing one-stop preventive, supportive and remedial services to residents in the catchment areas. It continues to use a child-centered, family- and community-based integrative approach, and strives to use a range of different methods and community resources to enable families to maximize their potential, to strengthen their relationships and bonds, and to assist individuals and families to prevent and effectively handle different problems and challenges they face. - New initiatives

The service has completed the narrative support programme for the victims of the typhoon John in July 2017, and published a journal with the title ‘Above the Storm: Stories of 5 victims of the illegal subdivided units on the roof floors’ for general circulation in October. It has also begun a support plan for single parents with returning permits, providing support services to this group of single parent families and facilitating the healthy development of their children in the community.

Casework

From April to September 2017, the service has handled a total of 1,036 (985:2016) cases. The nature of cases is similar to past few years, i.e. financial difficulties, housing needs, emotional problems and family relationship problems and so on. It has also handled 2,257 (2,194:2016)

intake cases, including 756 (721:2016) new cases, which reflect an increasing demand for casework service in the catchment areas. To help staff members further develop their professional skills, the service has made use of the SWD Fund to aim at enhancing NGO’s service delivery to run several seminars and workshops on integrated family systems therapy

on family strengths and resilience.

- Community work

The service has made the Family Support Plan for families with single parents on return permits, and successfully applied the HK Charity Foundation $150,000 (money received in June 2017) to run the support plan. Besides, it has also applied for subsidy from another foundation $100,000 (while waiting for the application result) for an experimental project to help families make use of family therapy sessions to resolve family issues. In the coming year, it is planned to initiate more special programmes to focus on the different needs that are emerging in the community. - Business processes improvement

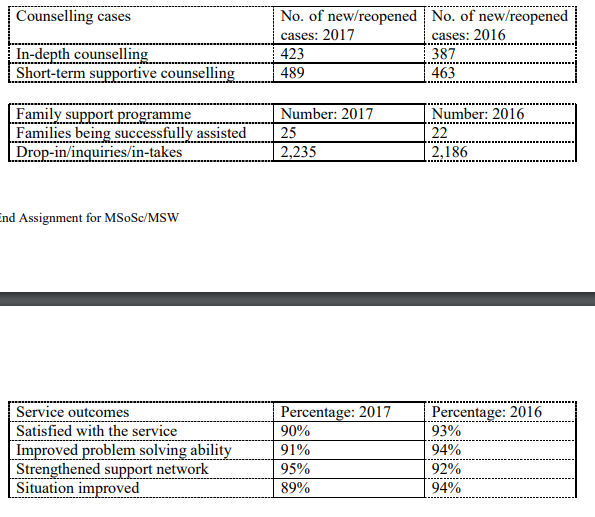

To meet the increasing demand for casework needs, the service has made plans to streamline the existing processes on casework intake, follow-up and problem solving. Besides, the service has used the SWD Fund to re-engineer the existing manual workflow system into an e-Workflow system. It is expected that the new system will be completed and implemented in the first quarter of 2018. The improvement will enhance the service quality provided to needy families, and the service can be able to reach out to the disadvantaged families more effectively to help them benefit from the resources and service network. - Service statistics

The service statistics for the period of April to end of September 2017 and the corresponding figures for 2016 are:

PART B

To respond to the service needs in the district, HKSSS is going to launch a new self-financed service of tuition and after school care service to children of working parents in the next school year 2018/19.

It aims to prevent home accidents that often happen when the children are being left unattended at home. It is planned to provide a safe decent environment for children's after school care, study support and cultivate their self-care and social skills. The service target group is children at the age of 12 or below.

You have asked your assistant, Jane who is Service Unit-in-charge to prepare a preliminary budget for running this new self-financed service. Although the budget prepared by her shows the breakeven (that is, a very small surplus amount of $180 is given) of the proposed service, you have read through the figures (Appendix B_Break-even of self-financed service) and have a feeling that she has made a number of omissions or mistakes and confused with the nature and concept of cost behaviour.

Meanwhile, when you asked her whether she has applied relevant costs concept in the budget for decision-making, she confused with the nature of relevant costs such as sunk cost, incremental cost, opportunity cost and notional cost. You think you have to coach her how to understand the relevant costs concept so that she could be able to better prepare the budget figures in the future.

TASK B: (Total: 15%)

You are given the budget prepared by Jane and your job is:

(a) Differentiate the items of fixed and variable costs shown in the budget.

(Note to students: it is possible that items can be fixed, variable or irrelevant costs. You need to follow and use the Appendix B sheet to complete your answer. When you have completed the sheet, you need to hand it separately through email at slam0603@hku.hk to the Course Teacher. When you submit your Excel file, you have to write down the

name and student number in this format: Your name_student number (e.g. Peter Chen_30xxxxxxxx) (4%)

(b) Explain the nature of fixed, variable and semi-variable costs, and why they are so important to help you formulate the decision. (3%)

(c) Apart from this, you are going to explain to Jane the concept of Break-even (B/E) analysis and how B/E analysis can properly be used to achieve a better decision-making. (3%)

(d) Write the coaching material on relevant costs particularly the areas that she has confused with: sunk cost, incremental cost, opportunity cost and notional cost. When preparing the material you have a strong feeling that she needs to distinguish these costs and how to apply and use them correctly. Therefore, you would include at least ONE example for each relevant cost. (5%)

(Note to students: you should write your own words, explain the concept behind the meaning of each relevant cost and illustrate with at least ONE example for that. Marks will not be given for any scripts simply copy and paste from any reference materials.)

PART C

As HKSSS has implemented the COSO Framework across its services for internal controls, each Senior Service Manager needs to carry out a periodical review of such controls among service units under his/her supervision in order to ensure that the unit’s internal control environment is properly governed by the Framework.

You recently had an opportunity to visit HKSSS Kowloon East Children and Family Services (the Service Unit). However, you have observed there are some areas that need to be investigated and followed up further after visit. The following are a summary of your findings.

Revenue collection and receipt

Apart from SWD’s subvention, HKSSS encourages each service to carry out some public relation activities to increase the revenue for the service. There are receipts from cash donations in the locked boxes placed in the service unit and from pledges by community benefactors who may issue monthly

or annual cheques, or make cash contributions to fulfill their pledges in services.

While you were in the Service Unit, you discovered that the locked boxes placed in the unit were opened alone by a Programme Worker with keys in a room. She took out the cash from those locked boxes, counted it out and wrote down the total amount of each locked box in a blank sheet. She then

checked the sheet total with the cash on hand and signed her name to evidence the total receipt in the sheet. There was no other staff to attend the procedures of opening the locked boxes; counting of cash from those boxes and verifying the record.

When you asked for a Daily Collection Summary Sheet (“DCSS”) of a particular workday, you observed the following:

The Administrative Assistant (“AA”) of the Service Unit would only mark the fee income collected in the workday in DCSS after she had banked the money into the bank account. In other words, the entries and total amount in DCSS were matched with the total amount of bank’s pay-in-slip for that particular workday. As there would be some days lapse between the cash receipt date and the bank-in date, the DCSS would only be updated afterwards. AA told you that such practice would avoid any discrepancies arising between DCSS and bank record. The matching of entry in DCSS and bank’s pay-in-slip would ensure that all transactions had been fully accounted for and reconciled with the bank’s passbook record for any subsequent checking.

When you asked the AA to provide you the official receipt book for review, you noted that not all revenue collections were issued with official receipts, particularly the donations were made by cheques. The AA explained to you that she would only issue official receipts if there were requests from donors and community benefactors. In other words, if there were no request, no official receipt would ever be issued and given. She would only enter the entry in the DCSS when the donations were collected in cash and would issue official receipts accordingly. You also observed when the AA

received cash from clients for routine fee income such as programme activity; she counted the money, issued and signed official receipts as well. If there was an amendment to the official receipt, she crossed out the error part such as the client’s name or the amount, rewrote the correct one and

initialed her signature again. There was no other staff to provide the review any of the above processes. You were given the answer that all staff members including the Service Unit-in-Charge were very busy in their daily work and they put the trust on each other for any work done.

Payment and Accounting records

When you reviewed the cheque payment procedures, you were told by the AA who was one to handle revenue collections that she kept the cheque book for the Service Unit and locked it in her drawer. Whenever payments were required each time, she took out the cheque book, marked the

details in the cheque stub and payment register, prepared and initialed payment vouchers (“PVs”), passed cheques together with PVs and supporting documents to the Service Unit-in-charge for checking and approval. The Service Unit-in-charge relied on the integrity of the AA and signed cheques immediately. She did not perform any checking on those PVs and supporting documents and left them to her AA for signature. The cheques would then be forwarded to you for co-signature. You did not perform any checking on those cheques and supporting documents since you thought your role was to ensure that the signature of the other signing staff, i.e. the Service Unit-in-charge was authentic in accordance with the COSO Framework. After the cheques were signed and returned, the

AA arranged the dispatch of cheques to the parties concerned, and filed PVs and supporting documents in the manner of sequential date order in the box files for external audit and SWD’s accounting inspection purposes.

Meanwhile, the AA was responsible for data entry of all receipts and payments in the financial management system. She marked the data entry number generated by the system in those receipt and payment vouchers and filed the same in box files but not with the supporting documents. Those supporting documents were filed in the separate box files in the sequential number order. Since the Service Unit-in-charge realized that the system had tighter controls over receipt, payment, accounting processing and fixed asset, she fully relied on the accounting information stored at and

generated by the system. At each month end, the AA arranged the print-out of a number of reports generated by the system, prepared the bank reconciliation with DCSS and got the signature on those reports from the Service Unit-in-charge who did not check or review the reports. Those reports would then be submitted to you for final review and assessment of financial performance of service.

You never spend the time to perform checks on the figures because you think it was the responsibility of the Service Unit-in-charge to check those reports. Also, you are confident with the recent improvements in the internal controls and the financial management system that there is no

error ever to be detected so far in the Service Unit. The financial statements, after having reviewed by you, will then be taken by Finance department as the evidence of the correct and proper accounting records of your services.

Petty cash

While you were in the Service Unit, you conducted a surprise cash count on petty cash balance held by the AA with the supporting documents for the claim. Among those supporting documents you discovered that there was a note of cash advance of $1,000 from a social worker who requested the

money for her personal use. The AA told you that the social worker was very busy in organizing programmes for clients and did not have the time to go to the bank for withdrawal of money from her personal bank account. She promised that she would repay the money later when she went to the

Automatic Teller Machine which was only a minute walk from the Service Unit to withdraw the money. The note only had the social worker’s signature but without any approval from her superior or Service Unit-in-charge and it was dated for a week ago.

After finished the cash counting, you noted that there was a shortage of cash $320 in the petty cash balance and no report was found to support or report the shortage. The AA could not explain to you why there was such shortage. Apart from that, it looked to you that the Service Unit did not follow the petty cash imprest system to arrange the reimbursement. According to the organization’s guideline, when the petty cash level runs low, the petty cash imprest is injected with cash by drawing a cheque and the required level is $1,000. However, the cash level during your surprise cash count was $550 and the AA did not seem there was an urgent need to arrange the reimbursement. She further explained that if there was not enough cash to pay for petty cash payment, she would provide her own money to pay for the sundry payment. She thought the petty cash reimbursement was done once a month. It looked to you that she did not understand the petty cash imprest system and confused with the importance of petty cash control.

Fixed assets

As the Service Unit-in-charge was newly promoted to take up the post, she heavily relied on the AA to conduct all fixed assets’ procurement including vendors’ sourcing and contacts, getting quotes, writing up the appropriate quotation forms and recording fixed assets being purchased for services.

The quotation records that you picked up for examination were not complete and they might omit some areas like the number of vendors required for quotation, the required specifications, incorrect calculation of total price and so on.

During the visit you observed the AA did not follow the organization’s guideline to classify the nature of assets, their categories and descriptions in the fixed asset register. It was found that the Service Unit-in-charge had left the discretion to the AA to determine which item was a fixed asset or

not. Thus, the AA employed her common sense and past experience to determine the asset types, names and descriptions for record purposes and marked those assets in the register accordingly.

Although each asset had its label attached for identification purposes, she did not write down the location because it would help her to transfer assets among different sections in the Service Unit easily if necessary. Since there was no asset location record in the Service Unit, the AA explained to

you that she had spent considerable time during the recent annual asset count to ascertain and locate the whereabouts of those assets. You were told by the Service Unit-in-charge that the AA was fully delegated to supervise the annual asset count exercise; to assign some assets count jobs to another

staff, a Workman; to mark the records and update the register individually. In other words, there was no peer review between the AA and Workman, they had put the trust on each other and the assets record filled up by each staff would be regarded as conclusive and final. The Service Unit-in-charge

never involved in any asset count exercise and only signed off the documents submitted by her staff.

Her explanation to you was that she was very busy in supervising and managing the service, and such job would be better to leave it to the AA who was in the Service Unit for more than 10 years and was familiar with the procedures. In the meantime, you could not locate any documents on assets transfer among different sections in the Service Unit, and there was common understanding that they did what they regarded to be the best way to suit their particular needs.

Upon picking up and checking a fixed asset disposal form, you noted that the AA prepared the disposal form with asset details and obtained the Service Unit-in-charge’s signature subsequently.

This could be seen from the fact that there were different dates shown in the application and approval of a particular asset disposal in the form. The interval of application and approval dates sometime could be a month. When checked with the fixed asset register, you found that the AA only entered the disposal details in the register but without writing any disposal reference number generated by the financial management system in the form and fixed asset register accordingly. She updated the system when she had the time to do so and filed the form in the box file for external audit and SWD’s accounting inspection purposes. You also noted that there was no enquiry from the Service Unit-in-charge regarding the whereabouts of assets being disposed of and whether the disposal of assets was due to damage, wear and tear, and obsolescence or loss. It seemed to you that she had put all the trust to the AA.

Finally, you noted that there were four items missing from the recent physical fixed assets count and the total remaining written down value was $50,870. There was neither to report for the discrepancy of assets nor to submit the investigation report from the Service Unit. When you asked the Service Unit-in-charge why there was no action being carried out, you were told that she was still locating the assets, she thought those assets might be transferred to other service units and she was waiting the reply from them. You were not satisfied with her explanation, as the physical checking of assets was conducted in late May this year and it had been more than five months before you discovered the missing of assets.

Task C: (Total: 20%)

(a) After visit of the Service Unit, you realize that the Service Unit does not properly follow the internal controls of COSO Framework in many areas as identified in your findings.

Therefore, you are going to write a memo to your Service Unit-in-charge identifying and reiterating the current internal control weaknesses and indicating your concerns that she needs to rectify those weaknesses under the Framework as soon as possible. In your memo, you would highlight the following internal control areas for follow-up (12%):

- Revenue collection and receipt

- Payment and Accounting records

- Petty cash

- Fixed Assets

(Note to students: you need to identify the problematic areas and what are their potential risks if internal controls are absent or inadequate in the Service Unit. You also need to provide feasible solutions for rectifying those weaknesses in your answer.)

(b) In the meantime, it seems that the Service Unit-in-charge is not fully aware of the general methodology and work approach under COSO Framework. These include the components of control environment, risk assessment, control activities, information and communication and

monitoring, evaluating and reporting. Therefore, you will arrange another coaching session to her by writing the detailed notes of how to make use of the Framework based on those internal control weaknesses identified in (a) for your coaching. (8%)

(Note to students: for the purpose of the Term End Assignment, you are NOT required to provide a full discussion of the COSO Framework and its applications in the internal controls. Rather what you need to do is to illustrate how different components of the Framework can help the Service Unit build up strong internal controls through the methodology and work approach in the service. You should take note that you would

not gain marks if you simply copy and paste the answer from reference materials.)

-END-