Financial management for decision-making and control

Assignment Briefing

| Module Name | Financial management for decision-making and control |

| Module Code | CB677 |

| Assignment Title | |

| Type of Assignment/Weighting | Individual project report /60% of the module mark |

| Word Count | Min 1,500 – Max 2,000 words |

| Issue Date | 15th February 2021 at 9 a.m. |

| Submission Date | 7th April 2021 at 12 a.m. (noon) |

| Date of feedback to students | End of first week of exam period |

| Where feedback can be found | In Moodle using the individual project submission link (top of the page under ‘assessment’) |

Instructions

Preparation time:

Students should individually work on their project report. The project text comprises two tasks with related sub-questions and both tasks require an answer. Students should devote a minimum of 20 hours to this assignment. This project is open booked. Students can use a calculator or an excel spreadsheet for doing the calculations.

Words limits:

The word limits for this assignment are 1,500 (minimum) and 2,000 (maximum). The word count includes everything in the body of the text such as comments, quotations, citations, footnotes and subheadings. It does not include: title, table of content, bibliography, financial statement tables with numbers and appendices, as they do not form part of the text. There is a +/-10% deviation tolerance in the total words count. Examiners will mark only up to that limit.

Format:

The report shall be written in word, converted in a pdf file and submitted in Moodle.

The pdf file to be submitted should be called: module code_login_surname_seminar group day and time (i.e. CB677_aa323_Smith_Tuesday10).

The pdf file must be set up so that it can be printed on A4 paper.

The student’s name, login, seminar group day and time, should appear on each page as part of the header.

Students have to fill in the cover sheet that is in Moodle and include it as the first page of their submitted file. The cover sheet must include the student’s name, login address, seminar day and time. It also contains a declaration that students need to sign electronically with which they declare that the work they submit is entirely their own work and they give consent for its submission to a plagiarism detection service.

All pages of the report are to be numbered.

The report should be written in Arial 12. In particular, financial statements tables with numbers can be made in Excel and they should be written in a font not smaller than Arial 12. If the font used in the tables is smaller, markers will only mark what they can read.

The total word count must be declared at the end of the report and on the cover sheet.

It is the student’s responsibility to make regular backups of the work so that, in case of IT problems, he/she will be able to complete and submit summative assignment by the deadline. Students should also keep a hard copy of their work in the event that the file cannot be opened or becomes corrupted before or after submission.

Assignment Text

There are two tasks in this coursework assignment. The assessment has quantitative and qualitative content. As a guide, students should expect task one of the assignment to take maximum four A4 pages and task two to take a maximum of other four A4 pages.

CASE STUDY: Prime & Vans

Rick Prime and Joanne Vans are two graduates in Bioscience at University of Kent. They have decided to open a small business specialized in door-to-door delivery of unperishable products in Ashford (Kent). Mrs Murple, an acquaintance of Rick and Joanne, owns a building near Ashford International train station and she is interested in renting it out to Rick and Joanne. An accountant friend has recommended to Rick and Joanne to prepare a business plan for their new business. The two graduates have limited business knowledge so they have contacted you for help with estimating the profitability, liquidity and sustainability of the business in the first year. Their business will start on the 1st January 2022. On that day, Rick and Joanne will deposit savings for £10,000 in the company bank account.

The business will be located in the building owned by Mrs Murple. The building includes a reception room, an office, a depot and a garage for the vehicles. Rick and Joanne expect that the reception will be open five days per week, from Monday to Friday from 10 a.m. to 6 p.m. The reception will take orders from customers for deliveries of parcels within Kent. Next, each order will be passed to one of the drivers who will be assigned the job to collect the parcel from the sender address and deliver the parcel to the receiver address. Rick and Joanne plan to have four drivers, using a van each. Each driver will work five eight-hour shifts per week (assume Monday to Friday from 10 a.m. to 6 p.m.) for 52 weeks per year. No overtime will be paid. Rick and Joanne have done some market research and they assume that each driver will be able to collect and deliver door-to-door within Kent a maximum of 120 parcels per working day. However, given the current economic situation, they prudently estimate to obtain 60% of that amount from each driver for the first three months and 80% for the rest of the year. The average price per average size parcel collected and delivered door-to-door is estimated at £4 for the first three months, rising to £5 thereafter. It is envisaged that 40% of sales will be paid by credit card, (these payments will be received the following month), 20% of sales will be done with account customers who will pay two months later. The remaining sales will be done with customers that will pay immediately by debit card or cash.

Rick and Joanne plan to rent the four vans. The rental contract will require a £200 monthly payment per van (this includes maintenance costs and road tax), in addition to an initial payment of £3,200 per van. Rick and Joanne expect to pay the initial payment for the four vans by bank transfer at the beginning of the first month of trading and the monthly payments by direct debit, starting from the end of January. They estimate that the fuel cost will be 25% of revenue and it will be paid in the month after the one in which it will be purchased. The rent of the building with all the facilities installed and the local property tax charges will be £21,600 and £9,000 per year respectively, both of which are payable at the beginning of each quarter.

Rick will manage the office while Joanne will manage the reception taking customers’ orders and directing drivers. Rick and Joanne salary will be £20,000 each per year. Each driver salary will be £26,000 per year. Social security costs will add 12% to all salaries cost. All labour costs will be paid in the third week of each month. Utilities (water, electricity and phone costs) are expected to be £3,500 per quarter, payable by direct debit in the first week of the following quarter.

To bring the business to the attention of the public, Rick and Joanne plan to spend £6,000 on advertising, including printing out business cards and leaflets. They will make two equal payments in the first two weeks of trading to pay this cost. These payments will cover the first six months’ worth of promotion. Rick and Joanne then plan to pay £1,000 per quarter thereafter.

At the beginning of the second year of trading, Rick and Joanne anticipate to expand the business by buying two new vans. They estimate the cash outflow for this investment to be equal to £22,000.

Required:

Task 1: Company business plan.

(1.a) Prepare a budgeted income statement (contribution margin format) for Prime & Vans for the year ending 31st December 2022.

(1.b) Prepare a monthly cash budget for Prime & Vans for the first six months of operation and a quarterly cash budget for the other 6 months up to 31st December 2022. Indicate also the total for the year column.

(1.c) Prepare a budgeted balance sheet (net assets equal equity format) for Prime & Vans at 31st December 2022.

(1.d) Do a cost-volume profit analysis: calculate the break-even point in sales revenues and the margin of safety in sales revenues for the business. Briefly comment on your results explaining to Rick and Joanne the meaning of these two concepts.

Maximum 200 words. Task 1: Total 40 marks.

Task 2: Business report about the company business plan.

Your report addressed to Rick and Joanne should include the following:

(2.a)

(2.b)

(2.c)

Critical analysis of the business plan assumptions. Use your results of task 1 to evaluate critically the assumptions made by Rick and Joanne in the business plan. You need to include evidence of competition analysis, demographic analysis and characteristics of the location to evaluate the owners’ assumptions (you need to do a data search for this type of information).

Analysis of the impact of the business plan on the company profitability, liquidity and sustainability. Use your results of task 1 to answer these questions: does the company generate contribution margin and profit? In terms of liquidity, how the net cash flow and the closing balance are evolving during the year and how much cash is necessary to fund the first year of business? Can the company survive in the short-term? Can it be solvent and grow in the long-term? Discuss pros and cons of multiple sources of finance that Rick and Joanne could use to obtain the necessary funds.

Your recommendations and advices to Rick and Joanne for establishing a successful business. Provide them with your own advices. Consider strategic, marketing and financial aspects. Will Rick and Joanne be able to expand the business and buy the two new vans in January 2023?

Maximum 1,800 words. Task 2: Total 60 marks. Overall Assignment: Word count: maximum 2,000 words. Total marks: 100.

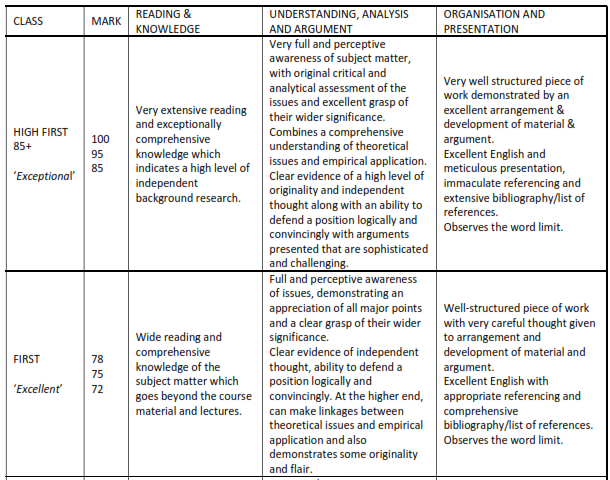

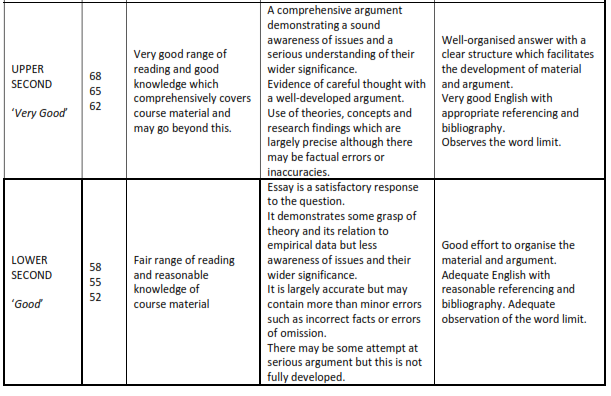

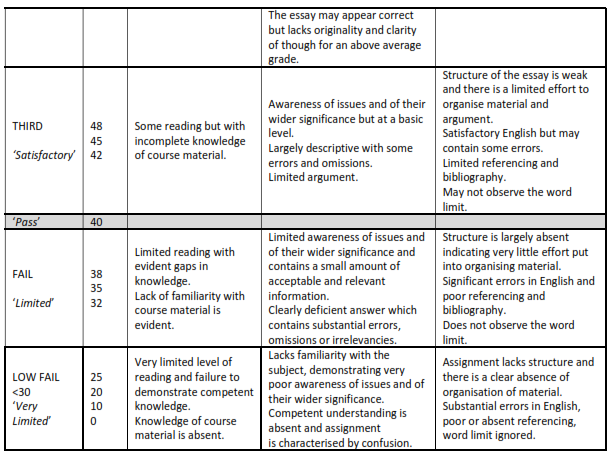

Assignment Marking Criteria (Task 2)

KBS UNDERGRADUATE CATEGORICAL MARKING CRITERIA

Avoiding plagiarism

What is plagiarism?

Plagiarism is a form of academic misconduct. Plagiarism may be committed in a number of ways, including:

Copying another person's work or ideas. This includes copying from other students and from published or unpublished material such as books, internet sources, paper mills, computer code, designs or similar

Submitting previously submitted or assessed work of your own without attribution

Submitting work solicited from (or written by) others

Failing to adequately reference your sources

Plagiarism and duplication of material, as defined below, are cited in the regulations as examples of breaches of General Regulation V.3:

Plagiarism: Reproducing in any work submitted for assessment or review (for example, examination answers, essays, project reports, dissertations or theses) any material derived from work authored by another without clearly acknowledging the source

Duplication of material: Reproducing in any submitted work any substantial amount of material used by that student in other work for assessment, either at this University or elsewhere, without acknowledging that such work has been so submitted

What are the penalties for plagiarism and duplication of material?

The penalties can be severe. They include marks of zero for individual coursework and de- registration from university for serious or repeat offences. Additionally, offences may be noted in your student record.

For more information on plagiarism (and referencing) please see the KBS Student Handbook and the universities policy on academic discipline (Annex 10 of the Credit Framework) which can be found at:

http://www.kent.ac.uk/teaching/qa/credit-framework/creditinfoannex10.html

Therefore it is vital that you ensure all assignments are your own work and follow good academic practice, including the correct academic referencing.

Advice on avoiding plagiarism and the University’s guide to academic integrity, plagiarism and Turnitin, the plagiarism detection software used by the University, can be found at:

http://www.kent.ac.uk/uelt/ai/students/

http://www.kent.ac.uk/uelt/ai/students/avoidingplagiarism.html

Illness or other mitigating circumstances

All students have a responsibility to manage their learning, revision and assessment activities throughout the duration of each term. Unfortunately illnesses and difficult and distressing events are a normal part of life and students are expected to manage these and continue with their work and study.

However, there may be times when illness or other misfortune cause exceptional interference with academic performance over and above the normal difficulties experienced in life. If you are experiencing personal factors which are impacting on your academic studies – please refer to the KBS Student Support Moodle site for comprehensive information relating to the school’s concessionary procedures.