Andromeda Resources: The Kimberley Metallica Project

Andromeda made an important discovery of a valuable metallica mineral resource in the Kimberley region in 2014. After the initial discovery, a drilling programme was undertaken during 2015 and 2016 to define the resource, and after promising results, a detailed feasibility study was

commissioned. It is early 2017 and the feasibility study is being finalised. A critical part of the feasibility study is to determine if it makes economic sense to proceed with mining. Your task is to assess the economic viability of mining by conducting a discounted cash flow analysis of the proposed project. In addition, Andromeda intends to finance the bulk of the project’s capital requirement from non-recourse bank debt and the bankers will need to be convinced that the project can generate sufficient cash flow to enable payment of interest and repayment of the principal during the first six years of production from the mine. A separate financial analysis will be

required to determine if the proposed financing structure is viable.

The project in brief

If the metallica ore body proves economic to develop the ore will be extracted by open cut methods due to the near-surface location of the mineralisation. The ore will then be transported to the concentration mill where it will be ground, mixed with water and purified by having air bubbles blown through the water which will carry the mineral particles to the surface. The dewatered mineral concentrate is then shipped to a smelter to produce pure metallica for sale to the final customer.

The ore reserve

After the initial discovery, a drilling program was undertaken to define the resource. The total resource in 800 blocks of ore has been estimated at 5.5 million tonnes and the weighted average grade of all 800 blocks is 3.7%. However some of the lower grade blocks will be uneconomic to mine

and treat since a lower grade means, all other things being equal, a higher unit cost per tonne of extracted metal. The ore reserve above the cut-off grade has been estimated at approximately 4.1 million tonnes with a weighted average grade of 4.1%.

The mining schedule

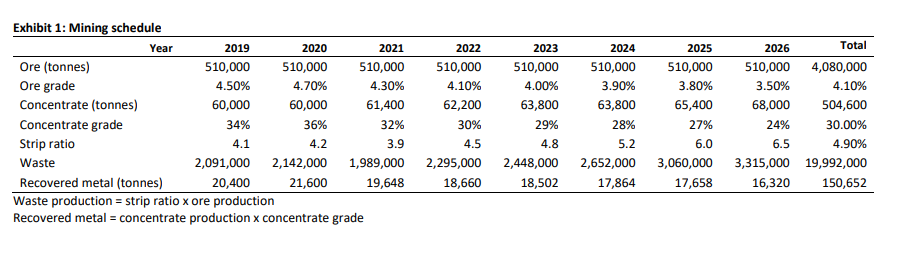

A mining plan has been developed to ensure an adequate supply of ore to the concentration mill while maximizing cash flow as early as possible in the life of the mine to maximise the net present value (NPV) of the project. The mining schedule is detailed in Exhibit 1.

An annual milling rate of 510,000 tonnes has been chosen as a reasonable rate, given the size of the deposit and likely final demand for the refined product. This equates to an hourly mill throughput of 64 tonnes based on 95% availability and two weeks per annum for preventative maintenance.

The strip or waste-to-ore ratio will vary over the life of the mine, rising towards the end as the depth of the mine increases. The strip ratio over the life of the mine is 4.9.

Capital costs

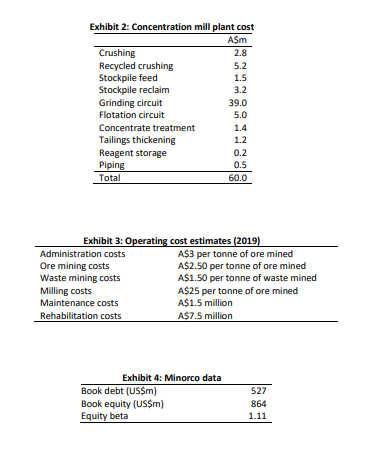

Ground works, tailings dam, power supply, water and mine accommodation have been estimated to cost $20 million. The cost of the concentration mill plant with an annual capacity of 600,000 tonnes has been estimated at $60 million (see Exhibit 2).

Construction will commence in 2017 and be completed in 2018. Capital spending is estimated at $20 million in 2017 and $60 million in 2018. The total capital cost will be depreciated over the eight-year operating life of the mine on a per-tonne-of-metallica produced basis.

No costings have been provided for the mining fleet as this will be provided by the mining contractor.

The project will require an additional $5 million in working capital before production commences and this will be recovered in the final year of the mine’s life.

Revenues and operating costs

The price of metallica in year 1 is forecast at US$2,750 per tonne for 2019 and is expected to rise at 2% per annum over the life of the mine. The exchange rate is expected to remain constant at A$1/US$0.75 over the life of the mine. Given the relatively low tonnage of concentrate shipped each

year delays in transportation are not expected and therefore, for simplicity, all sales and revenue are expected in the year of production.

The net revenue to the mine is calculated by subtracting the smelter and refining charges per tonne of metal and the costs of marketing, insurance and freight based on a per tonne of concentrate basis. The forecast smelter and refining charge of US$500 per tonne in 2019 and is expected to

increase in line with the price of metallica. The marketing, insurance and freight cost is estimated at A$50 per tonne of concentrate in 2019. This cost is expected to increase at 3% per annum over the life of the mine.

A 5% royalty is payable to the state government of Western Australia. The royalty payment is calculated on the net revenue of the mine. Estimates of the administration, mining, milling and maintenance costs of the project in 2019 are listed in Exhibit 3. These costs are expected to increase at 3% per annum over the life of the mine. In addition to these costs Andromeda has negotiated a fixed price contract for $5 million of specialised maintenance work on the concentration mill. This work will be done, and the cost incurred, at the end of the fourth year of production.

Finally, significant costs will be incurred in the final year of the project in rehabilitating the mine site.

The deeper parts of the mine pit will need to be back-filled, waste dumps bulldozed and contaminated earth treated. The estimated rehabilitation cost, in 2019 prices, is reported in Exhibit

- This cost is expected to increase at 3% per annum over the life of the mine.

Project discount rate

The discount rate employed in the NPV analysis must reflect the risk of the project’s cash flows. It is not appropriate to use Andromeda’s weighted average cost of capital (WACC) as the discount rate because the metallica project has a different risk profile to Andromeda’s existing resource projects.

The discount rate for the project must reflect the returns demanded by the providers of the project’s debt and equity finance.

Metallica is a scarce mineral and the only other two metallica mines are in the US, in Nevada, and in Chile. The mine in Nevada is the only asset of Minorco, a publicly-listed mining company. Data on Minorco’s capital structure and equity beta are provided in Exhibit 4.

The yield on ten-year Commonwealth Government Securities is regarded as a benchmark for the long-term risk-free rate in Australia. The ten-year yield is currently 2.95%. The standard equity market risk premium (MRP) used by practitioners in Australia is 6.5%. The corporate tax rate in Australia is 30%.

Project financing

Andromeda will use a project financing structure for the project. A special purpose vehicle (SPV) will be established to undertake the project, financed by a $25 million equity injection from Andromeda and a bank loan of $60 million. Andromeda’s $25 million equity contribution will pay for the capital costs incurred in 2017 and the build-up in working capital that takes place in 2018. The bank loan will be drawdown in 2018 to pay for the construction of the concentration mill.

The loan will be a non-recourse loan i.e. the bank will look to the cash flows from the project SPV for repayment of the loan plus interest rather than to Andromeda, although the project’s assets will serve as collateral for the loan. The indicative interest rate on the project loan is 10% per annum and

the term of the loan will be six years. Repayments on the table loan will be made in six equal instalments at year end, with the first payment due at the end of 2019 and the final payment due at the end of 2024.

Instructions

Assignments are to be prepared in MS Word and submitted in PDF on the LMS. Include your tutorial time, tutor’s name, group number and group member names and their student numbers on the front page of your submission. Submit the PDF document only – MS Word or Excel files are not

acceptable.

- Complete the project evaluation template for the metallica project.1 To complete the template enter the appropriate figures or formulae only in cells that have been shaded grey.

Do not make any changes to the format of the template. When you have completed the template, copy and paste the template into Appendix 1 of the MS Word document. Appendix 1 should be in landscape format. Please ensure that your spreadsheet is formatted in a way that makes it easy to be read and marked. (25 marks) - Calculate the project discount rate. Show all working and provide an explanation. The cost of equity should be obtained using the ‘pure play’ method.2 All figures should be reported to two decimal places.

(10 marks) - Does it make economic sense for Andromeda Resources to proceed with the project? Justfiy your answer. Limit of 100 words.

(5 marks) - The cash flows of the metallica project are highly sensitive to the geological, technical and economic assumptions that have been made. Use sensitivity analysis to determine the impact on project NPV of a 10% plus or minus change in (a) ore yields (proxied by annual concentrate

production), (b) the $80 million capital cost of the project, (c) the price of metallica, and (d) all mine operating costs. You should provide a summary table listing your results and a description of how these results were obtained. Limit of 200 words.

(10 marks) - Can the project generate sufficient cash flows to repay interest and principal to the bank during the first six years of production? Limit of 100 words.

(4 marks) - A critical factor in the financial evaluation of a mining project is the path of the commodity price. What is the 2019 price of metallica that (a) yields a project NPV of zero, and (b) ensures annual project cash flow is sufficient to meet projected interest and principal payments in all

years?3 In broad terms, what options would Andromeda have for mitigating the commodity price risk it faces? Limit of 100 words.

(6 marks)

Total: 60 marks