Solved: ADAM AND JESS KEANE INDIVIDUAL FEDERAL INCOME TAX RETURN

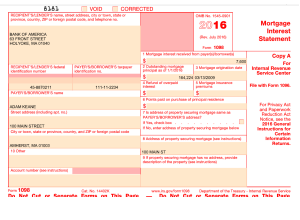

Adam S. (age 42), SSN 111-11-2234, and Jess N. (age 41), SSN 123-45-6787, Keane are married and live at 100 Main Street, Amherst, MA 01103. Adam is the regional manager for a restaurant chain, Food-A-Licious, and Jess is a self-employed architect and she also works part time for 3MG Architects as an architect.

The following filing information relates to the Keanes:

• The Keanes wish to file as married filing jointly for 2016.

• Jess elects to contribute to the Presidential Election Campaign Fund.

Adam does not make this election.

• The Keanes are both calendar year taxpayers.

• The Keanes both follow the cash receipts method.

• The Keanes prefer that any tax overpayment be refunded rather than

credited to their 2016 Federal tax return.

• Round all cents to the nearest dollar (Round up .50 Round down .49) No cents on the return.

- Adam’s annual salaries from Food-A-Licious and Jess’s from 3MG Architects are included on the attached W-2’s. Food-A-Licious does not provide any retirement benefits. Adam contributes $4,000 to a Roth IRA

- Jess Keane is a licensed architect who works part time on a consulting basis. Her professional activity code is 541310 and her employer identification number is 01-2345671. Jess has an office on 85 Main Street, Amherst, MA 01003. Her major clients are real estate developers (both

residential and commercial) for whom she prepares structural designs and construction plans.

She also advises on building code requirements regarding the renovation and remodeling of existing structures. Jess collected $83,500 in consulting fees during 2016. This total includes a $4,000 payment for work she performed in 2015 and does not include $4,000 she billed in

December for work performed in late 2016. In addition, Jess has an unpaid invoice for $3,500 from a client for work done in 2014. This client was convicted of arson in August 2016 and is now serving a five-year sentence in state prison. Jess feels certain that she will never collect the

$3,500 she is owed.

Jess does her work at her office. Her business expenses for 2016 are as follows:

All of the assets listed above were purchased new by Jess on the date they were placed into service. For Assets placed in service in 2016, Jess elected the cost recovery method that yielded the highest possible cost recovery deduction method for that year.

For assets purchased prior to 2016, all of these assets were depreciated under the MACRS method (None were depreciated under Section 179). For each year of acquisition, the highest possible deduction under MACRS was elected. Accordingly the expense method of §179 was not elected.

No additional first year depreciation was taken in any year.

- One of Jess’s clients is interested in building a shopping center on a tract of land that Jess currently owns in Franklin County. Jess inherited a piece property in New Hampshire from her aunt when she died on March 9, 1989. Her aunt purchased the land in 1981 for $35,000. At the date of her death, the land was worth $60,000. It had since been rezoned for commercial use and had a value of $110,000. On November 11, 2014, Jess exchanged the New Hampshire parcel for a similar tract in Franklin County worth $110,000 in a nontaxable exchange.

- On August 2, 2016, Jess sold the tract of land in Franklin County (from Item 3) to her client.

Under the terms of the sale, Jess received cash of $115,000 for the sale of the land. - A. The Keanes sold no stock that was reported on Form 1099-B:

B. The Keanes sold the following capital assets which are not reported on and Form 1099-B:

• 674 shares of Walnut Corporation. The shares were purchased by Jess for $2,185 on the New York Stock Exchange on May 6, 2010. They were

sold on the New York Stock Exchange for $1,459 on June 2.

• A gold pocket watch. The watch was inherited by Adam from his

mother on September 19, 2012. The basis of the watch to his mother

was $3,780. The fair market value of the watch at the time of her

death was $11,500, but $10,000 six months after her death. The

executor of her estate did NOT elect the alternate valuation date. The

watch was sold to an unrelated jewelry dealer for $16,000 on August

19.

• 1,000 shares of WAY, Inc. The shares were received by Adam as a

gift from his father on April 20, 2010. The father purchased the stock

on 10/01/05 for $2,750. The fair market value of the stock at the time

of the gift was $2,225. No gift tax was paid on the transfer. The stock

was sold to an unrelated party on September 11 for $2,100.

• On August 5, 2011, Adam purchased 1,000 shares of Farmer’s

Markets America (FMA) common stock for $16 a share as part of its

initial public offering. The corporation was formed to establish and

operate farmers’ markets in mid-size cities throughout the United

States. Although some market locations were profitable, the venture

as a whole proved to be a failure. In November 2016, FMA’s remaining assets were seized by its creditors, and FMA stock became worthless.

• Adam has a long-term capital loss carryover of $7,500 from 2015

All of the capital assets listed above were held by the Keanes for investment purposes. - In early 2015, Adam learned that one of his restaurant managers, Carrie Jones, going through a divorce from her husband Steve. During the divorce, Carrie decided it was time for her and her daughter to move. Before they left on April 14, 2015, Adam loaned Carrie $3,250 to help with

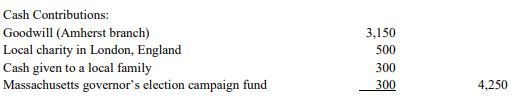

the relocation. Adam had her sign a note due in one year. Shortly after Adam loaned the money to Carrie, she disappeared and Adam never heard from her again. Adam assumes that this note is fully worthless and he will never collect on it. - Besides the items previously noted, the Keanes had the following receipts for 2016:

The life insurance premiums relate to the universal life insurance policies that Adam and Jess own. The first beneficiary on both policies is the other spouse, with the second beneficiaries being the children. Jess contributed to the governor’s campaign fund because she thinks his influence is key in getting the Franklin County land rezoned for commercial use (see item

above).

In September 2016, the Massachusetts Department of Revenue audited the Keane’s state income tax return for 2014. They were assessed additional state income tax of $560 for that year.

Surprisingly, no interest was included in the assessment. The Keane’s paid back the taxes promptly.

- The Keane's home was burglarized on July 4. Jess's diamond earrings worth $32,000 were stolen. Jess bought the earrings on June 26, 2006 for $27,000. The ring was not recovered.

Insurance recovery was limited to $2,500. It was not held as a collectible item. - Relevant Social Security numbers are as follows:

Name Social Security Number

• Carm A Keane, son, SSN 123-45-6783. Born February 19, 1996. Car

mechanic in Holyoke, MA. The Keane’s provided none of Carm’s support. He lived in Holyoke for the entire year. His income consisted of wages of $35,000.

• Steve J. Keane, son, SSN 123-45-6789. Born February 19, 1996. Full-time student at St.Michaels College before graduating in May. Of his total support, t he Keane’s provided 55 percent, Steve provided 35 percent and the balance came from other sources. Steve’s sole income consisted of wages and tips aggregating $17,080 earned as a waiter. He lived

with the Keane’s all year.

• Ella Keane, daughter, SSN 123-45-6785. Born June 2, 1998. Part-time student at University of Massachusetts. The Keane provided 70 percent of her support.

Her income consisted solely of $8,000 earned from an internship as a computer analyst. She did not live with the Keane’s for any part of the year.

• Ava Keane, daughter, SSN 123-45-6786. Born December 12, 1999. Full-time student at the University of Maine. The Keane’s provided 100 percent of her support. She earned no income. She lived with the Keane over the summer break.

The Keane also supported the following person:

Tony Keane, cousin of Adam, SSN 123-45-6788. Widower. Born January 19, 1969. Tony lives with Adam and Jess. The Keane’s provided 65 percent of his total support. His sole income consisted of $3,950 of dividend income.

• Andrea Paul Kondej, mother of Jess, SSN 123-45-6780. Widow. Born August 17, 1933.

Resided in Phoenix, Arizona. Jess provided 65 percent of her total support. Her sole income consisted of $4,350 of interest and dividends and $7,900 of Social Security benefits.

- The Keanes made the following deposits with the United States Treasury

for their Federal income tax liability from their own personal checking

account on the dates indicated:

- All source documents for wages, dividends and interest paid are at the end. These items are not reported in any of the information above. Ignore the year on the source documents and assume that they are all for the tax year 2016.

REQUIREMENT

Prepare the Federal income tax return with all supporting schedules and

attachments for Adam and Jess Keane for 2016. Specifically, submit the

following completed forms with required schedules:

• Form 1040: U.S. Individual Income Tax Return

• Form 1040 Schedule A: Itemized Deductions

• Form 1040 Schedule B: Interest and Ordinary Dividends

• Form 1040 Schedule C: Profit and Loss from Business

• Form 1040 Schedule D: Capital Gains and Losses

• Form 1040 Schedule SE: Self-Employment Tax

• Form 4562: Depreciation and Amortization (For Schedule C)

• Form 4684: Casualties and Thefts

• Form 8949: Sales and Other Dispositions of Capital Assets

Use all opportunities to minimize tax liability. In this regard, assume that the Keanes always prefer to forego potential future tax savings in favor of current year tax savings