Solved: Assignment 8-Bayer-Monsanto: the challenges of a Mega-merger

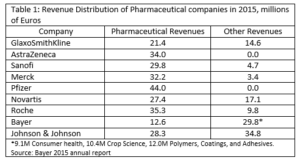

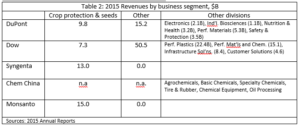

Adapted from “Bayer-Monsanto: the challenges of a Mega-merger. Case #9B17M182 and Teaching Note #8B17M182 Ivey Publishing In 2016, the German multinational Bayer AG and the U.S.-based Monsanto Company agreed to merge, potentially creating the world’s largest integrated pesticide and seeds company. The agrochemicals and pharmaceuticals industries have several attributes in common. Both have large markets and high growth potential. Both industries also have strong technological roots in chemistry and biology. Too, the R&D intensity is high in both industries. Monsanto, for example, spends over 10% of its revenues on R&D whereas the average pharmaceutical firms spends 13%. Both industries are also subject to strict government regulation. For example, safety reviews of new products are commonplace in pharmaceuticals while genetically modified organisms are forbidden in Europe. Nevertheless, there were some differences. For example, while the pharmaceutical industry is rather fragmented, agrochemicals was not - 6 companies controlled 2/3 of the seed business and 3/4 of the pesticide market. Moreover, the pharmaceutical industry is characterized by long product life cycles (e.g., 12 years) and heavy up-front investments in R&D to discover new products. To compound this risk, Bayer had a relatively limited portfolio in pharmaceuticals (15 products accounted for 80% of its 2015 pharmaceutical revenues). Other factors favored the merger. For example, while Monsanto had a strong presence in America (53% of its sales), Bayer’s geographical presence was stronger in Europe. Too, it was anticipated that knowledge from Bayer’s pharmaceuticals and crop science research could be shared across Monsanto’s animal health business. Both sides also anticipated additional benefits from the overlap in customers – farmers - and from bundling seeds and pesticides in an exclusive package. In addition, though Bayer had traditionally been weak in seeds – they represented only 12% of crop science division sales - Monsanto’s expertise in this area was thought to be a good complement. In fact, Monsanto’s seeds had been engineered to be resistant its Roundup herbicide. Furthermore, Bayer’s new CEO, Werner Baumann, had previously managed the strategy and portfolio department at Bayer and, consequently, had a good deal of M&A experience. And finally, both companies were focusing on “big data” to provide new services and more precision for farmers. The possibility of a huge data bank created by the convergence of the data from both sides promised further productivity improvements.

Nevertheless, although agrochemicals could be considered an oligarchic industry dominated by firms such as DuPont, Syngenta, Monsanto, and Bayer, even the leading players had been struggling recently with a new wave of mergers and acquisitions. For example, after Monsanto had made three unsuccessful attempts to acquire Syngenta in 2014-2015, Dow and Dupont merged in December 2015 and Syngenta merged with ChemChina in February 2016.

Other factors favored the merger. For example, while Monsanto had a strong presence in America (53% of its sales), Bayer’s geographical presence was stronger in Europe. Too, it was anticipated that knowledge from Bayer’s pharmaceuticals and crop science research could be shared across Monsanto’s animal health business. Both sides also anticipated additional benefits from the overlap in customers – farmers - and from bundling seeds and pesticides in an exclusive package. In addition, though Bayer had traditionally been weak in seeds – they represented only 12% of crop science division sales - Monsanto’s expertise in this area was thought to be a good complement. In fact, Monsanto’s seeds had been engineered to be resistant its Roundup herbicide. Furthermore, Bayer’s new CEO, Werner Baumann, had previously managed the strategy and portfolio department at Bayer and, consequently, had a good deal of M&A experience. And finally, both companies were focusing on “big data” to provide new services and more precision for farmers. The possibility of a huge data bank created by the convergence of the data from both sides promised further productivity improvements.

Nevertheless, although agrochemicals could be considered an oligarchic industry dominated by firms such as DuPont, Syngenta, Monsanto, and Bayer, even the leading players had been struggling recently with a new wave of mergers and acquisitions. For example, after Monsanto had made three unsuccessful attempts to acquire Syngenta in 2014-2015, Dow and Dupont merged in December 2015 and Syngenta merged with ChemChina in February 2016.

Furthermore, Bayer and Monsanto would need to obtain approval from regulators in over 30 countries to close the deal. U.S. regulators had opposed the merger but the ascension of Donald Trump to the presidency (he argued that agriculture had needed more innovation) boded well for approval of the combination in the U.S. The European Union, on the other hand, had opposed Monsanto, especially its genetically-modified organisms (GMO).

Diana L. Moss, president of the American Antitrust Institute, also pointed out that

“The United States Department of Agriculture (USDA) notes that the price of farm inputs, led by crop seed, generally have risen faster over the last twenty years than the prices farmers have received for their commodities. Moreover, seed prices have outpaced yield increases over time. And finally, the USDA has determined that increasing levels of concentration in agricultural input markets (including crop seeds) are no longer generally associated with higher R&D or a permanent rise in R&D intensity.”

Therefore, we might conclude that this consolidation would negatively pressure consumers and farmers.

HW#8

Questions:

The preceding discussion documents Bayer’s attempt to further diversify its portfolio of businesses.

Furthermore, Bayer and Monsanto would need to obtain approval from regulators in over 30 countries to close the deal. U.S. regulators had opposed the merger but the ascension of Donald Trump to the presidency (he argued that agriculture had needed more innovation) boded well for approval of the combination in the U.S. The European Union, on the other hand, had opposed Monsanto, especially its genetically-modified organisms (GMO).

Diana L. Moss, president of the American Antitrust Institute, also pointed out that

“The United States Department of Agriculture (USDA) notes that the price of farm inputs, led by crop seed, generally have risen faster over the last twenty years than the prices farmers have received for their commodities. Moreover, seed prices have outpaced yield increases over time. And finally, the USDA has determined that increasing levels of concentration in agricultural input markets (including crop seeds) are no longer generally associated with higher R&D or a permanent rise in R&D intensity.”

Therefore, we might conclude that this consolidation would negatively pressure consumers and farmers.

HW#8

Questions:

The preceding discussion documents Bayer’s attempt to further diversify its portfolio of businesses.

- What weaknesses was Bayer trying to address via its diversification strategy?

- What opportunities in its environment (e.g., synergies created by merging with Monsanto) is Bayer trying to exploit via its diversification strategy? Is this a case of related or unrelated product/market diversification?

- Finally, according to the resource-based view, firms may differ in the amount of synergies they possess vis-a-vis target firms. Those with greater synergies may be able to profit more from the acquisition than their competitors. They may either (1) win the bid at a lower price, thereby earning above-normal profits, or (2) withdraw from the bidding if the target price becomes too high, allowing the winning bidder to earn below-normal profits.