Share Trading Assignment

Assignment Objectives

You are given a notional £100,000 to invest in the UK stock market in shares

listed on the FTSE ALL Share index. You need to split your investment 50:50 between two portfolios of shares, one where you selected the shares by fundamental analysis and the other by technical analysis. The aim is to

maximise the returns of the investment and try to beat the market with both portfolios, e.g. achieving a greater return on average than the market return during the period of trading. It is important you can demonstrate that you know the difference between these methods. You need to compare and contrast the two portfolios and you need to make explicit reference to Efficient Market Hypothesis (EMH) in your analysis.

Submission Requirements

x Word Limit: 2,500 words excluding references.

x Full references and an appendix with record/evidence of your trades

should be included.

x Your report needs to be submitted to Turnitin via unit Moodle site.

Assignment Requirements

x You are given a notional £100,000 to invest in the UK stock market.

x You have approximately four months to trade, e.g. Oct/Nov 2017 to

Jan/Feb 2018. This means that you are going to have to use short-term

investment strategies.

x You should demonstrate your understanding in equity investment and

be able to explain why you buy and sell the selected shares. The

market is represented by the FTSE ALL Share Index – if you do not

‘beat the market you will not lose marks. You must calculate the

return on the market from your first trade to your last trade in order to

determine whether you have beaten the market or not.

x The shares MUST be listed on the FTSE ALL Share.

x 50% of your investment must be based upon fundamental analysis and

the other 50% on technical analysis (Based on two theories – no more

or less, just TWO).

x Each of your portfolios must contain at least 5 companies.

x You are allowed to trade as many times as you like

Recommend Format

Introduction – You need to explain the strategies you used and which if any

of your portfolios beat the market.

Method – How did you select the companies for your portfolios? You don’t

have to give a list of every company and why, but you should explain your

stock selection criteria in general. The detailed reasons of buying and selling individual stocks should be in the appendix. You need to make reference to the technical theories you have used and justify your approach, this should be done by making direct references to the journal articles read.

Results – How did the portfolios perform? Did they beat the market, which

was best?

Conclusion – You need to tie your results back to the literature you have

read on the type of analysis you have used and the EMH.

Appendix – Spreadsheet of all of your trades, with notes on why you chose

your companies. The spreadsheet needs to have profit and loss for each of

your shares and should say your final profit. The spreadsheet needs to take

account for trading costs, see below for details.

Sources of Data

Company information, Market related news & events, Share prices

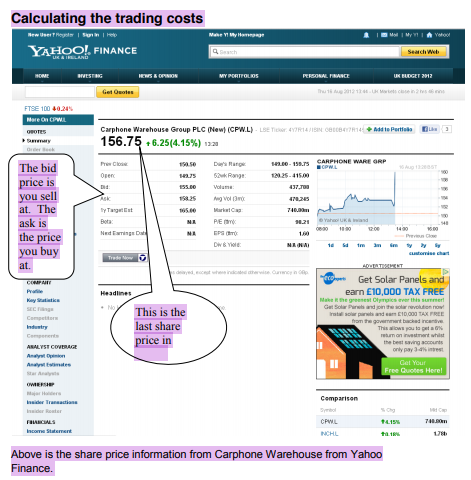

Yahoo Finance http://uk.finance.yahoo.com/

Morning Star http://companyintelligence.morningstar.com/client/portsmouth you need to access this from the university

Financial Times: you will have free access to FT.com as UOP student (register via

https://join.ft.com/46f97b26-fa94-4240-b542-6559e2806f95 )

Bloomberg Database – Bloomberg Suite (RB1.08).

S&P Capital IQ online access:

http://profile.standardandpoors.com/universityofportsmouth

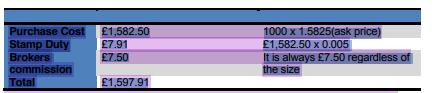

When you purchase shares you must also pay Stamp Duty of 0.5% of the purchase price. There is no Stamp Duty payable when you sell your shares.

You should also assume that you buy your shares online through an internet broker.

Assume that the broker charges you a flat fee of £7.50 per trade, i.e. £7.50 when you buy and £7.50 when you sell.

Example: You buy 1000 shares at Carphone Warehouse

Note: You can buy and sell in any amount you like. In our example we bought 1000 shares, but you do not have to buy in round amounts. For example, you could buy 798 shares or any other number you like.

Reading

Bondt, W. F., & Thaler, R. (1985). Does the stock market overreact?. The

Journal of finance, 40(3), 793-805.

Dimson, E., & Marsh, P. (1998). Murphy's law and market anomalies. Available at SSRN 135681.

Fama, E. F. (1991). Efficient capital markets: II. The journal of finance, 46(5),

1575-1617.

Fama, E. F. (1998). Market efficiency, long-term returns, and behavioral finance. Journal of financial economics, 49(3), 283-306.

Holthausen, R. W., & Larcker, D. F. (1992). The prediction of stock returns using financial statement information. Journal of Accounting and Economics, 15(2), 373-411.

Jegadeesh, N., & Titman, S. (1993). Returns to buying winners and selling

losers: Implications for stock market efficiency. The Journal of finance, 48(1), 65- 91.

Ou, J. A., & Penman, S. H. (1989). Financial statement analysis and the

prediction of stock returns. Journal of accounting and economics, 11(4), 295-

329.