A.G. Barr Plc Accounting

A.G. Barr p.l.c. is a United Kingdom Company. The company manufactures different brands of drinks depending on the subsidiaries. The main segments of production are water, and carbonates and still water drinks. A.G. Barr p.l.c brands include IRN-BRU, KA, D'N'B, Strathmore, Tizer, St. Clement's, Rubicon, Barr Brands, Findlays, Simply, and Abbott's. Apart from these, the company has partnership brands such as Rockstar, Orangina and Snapple.

In the 2011 fiscal year, A.G. Barr p.l.c. under KA portfolio expanded its product brands. It is new Still Juice brands were in flavoured carbonated black grapes, pineapple and fruit punch drinks. The company launched Rubicon Mango Light in April, and in May Appleade was also launched by the Barr brand. Among the strong A.G. Barr p.l.c. subsidiaries are Barr Leasing Limited. The subsidiary mainly engages in central commercial undertakings. Findlays Limited, on the other hand, is a mineral water bottler. Consequently, Rubicon Drinks Limited mainly manufactures soft drinks.

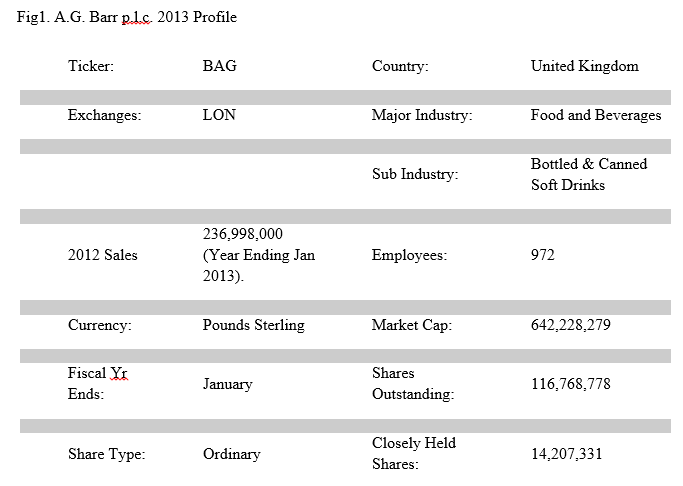

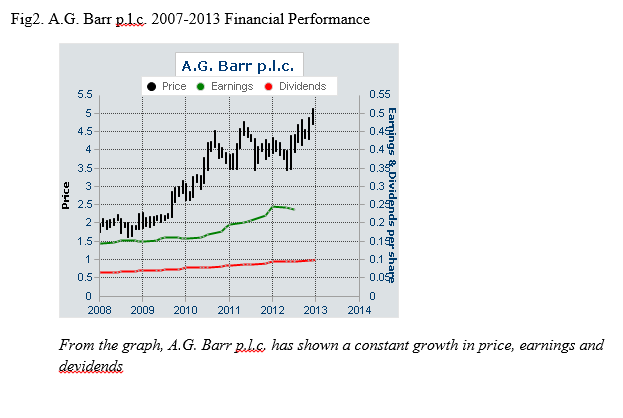

For the last five years, A.G. Barr p.l.c. has recorded constant sales growth. In the ended fiscal year (January, 2012), its sales were £237.00 million. This was a sales growth of 6.6% from the previous fiscal year. The company has recorded growth in sales since 2007. It has increased its sales by 67% from the 2006 fiscal year. In 2012, soft drinks sales increased by 9.4% (from £49.42 to £54.08) million. Despite the growth, some brands of reported sales decrease. The total decrease in segments was recorded at 7.9% (£580,000.00). However, the fall in the segments were insignificant as compared to the organizations overall growth. The table below shows A.G. Barr p.l.c. company profile. The subsequent table is a summary of its stock performance since 2007 and the latest weeks’ performance.

The Company’s Recent Performance

1 Week 5.8%

13 Weeks 11.3%

4 Weeks 23.4%

52 Weeks 34.1%

Organization Management

The Soft drinks industry is a very competitive field that requires firm managers to not only focus on their organizational structures, processes, and outcome, but also on the organization's external environment. A.G. Barr p.l.c today is fighting to strengthen its internal management while at the same time balancing outside pressures such as global economic changes, sustainable development and maintenance of competitive advantage. To achieve the goals, A.G. Barr p.l.c management is always engaged in market research, which has led to their constant branding and rebranding. Quality control is vital in any soft drink industry to maintain a competitive advantage over rivals; as a result, A.G. Barr p.l.c management is always engaged in monitoring and evaluation to maintain their customers’ satisfaction. Tied to these, are the development of cost effective measures to manage the organization's resources.

A.G. Barr p.l.c Accounting Management

Activity based costing (ABC) is a logical approach of cost allocation. Traditionally, costs were allocated based on machine working hours. Through activity costing, the actual cause of overhead is identified and costs are assigned based on priority of activities that demand them. Taking Strathmore and Tizer brands, as an example; if Strathmore, is a low volume product but with special engineering, testing, and many processing steps as compared to Tizer, which is a high volume product. Traditional costing will allocate will allocate more resources to Strathmore. However, CBA costing will only calculate costs based on demands. Tizer will not have allocation for special, engineering and many processing steps. Activity based cost, as a result, is a cost effective costing system.

For A.G. Barr p.l.c to run effectively, managers must develop an effective budgeting system. Normally, budgets should be monitored and evaluated with variance analysis. Budgets determine quantitative future operations. Additionally, it indicates cost outflows and revenue inflows objective and is the source of for appraisals. The main goals of budgeting is provide resources estimates, a basis for developing management system and policies in short and long term operations and provision of control method, through comparisons and evaluations.

Variance is the difference between actual and planned budget. Variance analysis provides information on the caurse of deviation on budgets. Thus, it can be favourable or unfavourable. Variance can either be cost or quantity variance. Example of variance analysis include, revenue variance analysis, sales, labour variance. While undertaking brand annual budgeting, i.e. Rubicon. A.G. Barr p.l.c can put adjustment on previous years’ budget or use zero-based budgeting. Budgeting variance analysis can be set quarterly or after every six months to detect deviation and apply corrective mechanism. Annual reports as well must reflect variance analysis of the brand to show whether there was a positive or negative deviation as per the initial budget. It is through the procedure that Rubicon productiveness will be assessed.

Investment appraisal is closely tied to capital budgeting. It evaluates investment proposal attractiveness through application of average return rate, payback period, or net present value. Mostly, investment appraisal is applied when the returns cannot easily be quantified such as human resource management, trainings and marketing. Rubicon manufacturing investment appraisal to justify training needs among the workforce. If the the brand can gain in short term or long term after investing in human resource training, it can opt to budget for training services despite the cost.

Benefits of Accounting Management

ABC is very crucial for A.G. Barr p.l.c. The company will be able to estimate individual cost of its product. When overhead costs are transferred to individual units, non-profitable and inefficient units can easily be identified. ABC is a basis for setting prices. Since individual input can be determined, price per output can easily be set. A.G. Barr p.l.c will be able to maximize its growth through eliminating non profitable areas. At the same time, it will maximize its profit through increased product value and competitive advantage. Through ABC, the organization will reduce wastages in non-profitable or non-remunerative units. Additionally, ABC provides quantifiable figures for future planning and evaluation purposes.

Budgeting and variance analysis will enable the company identify units, which over and under run their budgets, respectively. After identification, managers will be able to investigate and find potential was to create gains. Wastages and repetitions can be identified. At the same time, non-productive units can be eliminated to channel the resources to some productive areas. However, this normally takes some time in the production cycle.

The main disadvantage of budgeting and variance analysis is the time period it takes. At times the time frame is too large that control mechanism becomes hard to apply. Normally, budgeting and variance analysis identifies problems that cannot be corrected. It cannot be used effectively on its own without monitoring and evaluation system.

Investment appraisal payback period is simple to use. Integrating it in A.G. Barr p.l.c will not be a problem and the organization will have fast view of its recouping period. It is more effective in short term basis. Average rate of return clearly indicate investment profitability. At the same time it shows changes in interest rates, thus, it can be applied in determining alternative investments. A.G. Barr p.l.c will find this method useful before picking another brand. Net present value monitors interest rates; growth can easily be indicated. It strength is determination of future opportunity cost.

Limitations of Accounting Management

Activity based costing is a scientific approach, which is costly, complex and time consuming to implement. The process requires has a substantial financial impact since data management process is costly. ABC cannot be applied in situational management since the whole process requires a lot of time. ABC has no conformity with the General Accepted Accounting Principle (GAAP). Therefore, an organization applying ABC must have another book keeping system. ABC can only be applied in internal operations while a standard method is required to meet statuary and external organization usage. The process is deemed duplication and wastage of resources by most managers.

Through ABC, it is not possible to subdivide overhead cost per product consumption. On the other hand, employees do not achieve 100% productive work period, hence ABC makes a lot of assumptions. ABC insists on smaller details, which might be detrimental to larger organization picture. A.G. Barr p.l.c for example, can lose focus on its strategic goals. ABC might roll out a distributional channel as non-remunerative or ineffective effective while actual it is vital for the product channel in long term.

Investment appraisal on the other hand might be inappropriate for A.G. Barr p.l.c. The payback period is oversimplified, which can be misleading. The method is future bias as it overely on present value. Managers might find some decision making through this method complex as it lack qualitative aspect. Finally, payback period does not compare initial investment and the output. Average rate of return, nevertheless, is over optimistic in the future, which can mislead managers. The method also fails to provide recouping time of the initial investment and the consequence financial output. It also ignores qualitative aspect for decision making. Net present value solely relies on quantitative view, which is over bias for management.

References

Davis, C. E., & Davis, E. (2012). Managerial accounting. Hoboken, N.J.: John Wiley & Sons.

National Register of Archives (Scotland). (2009). A. G. Barr Plc, soft drink manufacturers, Cumbernauld. National Register of Archives for Scotland.

Stone, M. & Desmond, J. (2007). Fundamentals of Marketing. London: Taylor & Francis.

Needles, B. E., & Crosson, S. V. (2011). Managerial accounting principles (9th ed.). Australia: South-Western, Cengage Learning.